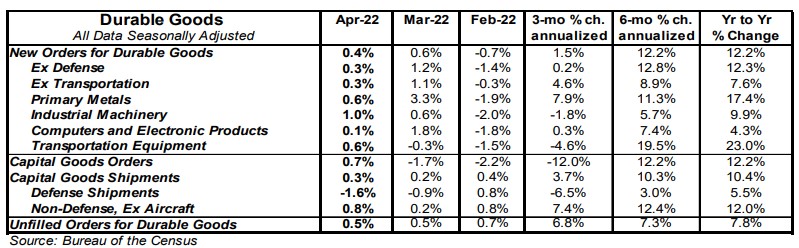

- New orders for durable goods rose 0.4% in April (+0.2% including revisions to prior months), versus a consensus expected +0.6%. Orders excluding transportation increased 0.3% in April, falling slightly short of the consensus expected gain of +0.6%. Orders are up 12.2% from a year ago, while orders excluding transportation are up 7.6%.

- The rise in orders in April was led by commercial aircraft, machinery, and primary metals.

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure increased 0.8% in April. If unchanged in May and June, these orders will be up at a 4.8% annualized rate in Q2 versus the Q1 average.

- Unfilled orders rose 0.5% in April and are up 7.8% in the past year.

Implications:

New orders for durable goods came in slightly short of consensus expectations in April, but continue to rise at a healthy pace. The underlying details of the report showed orders activity was largely positive, with commercial aircraft and industrial machinery the standouts. Auto orders, which surged 4.8% in March, declined 0.2% in April, but could not fully offset the 4.3% increase in orders for commercial aircraft. The transportation sector is notoriously volatile month-to-month, but stripping that out shows orders still grew 0.3% in April. Machinery orders rose a strong 1.0%, followed by primary metals (+0.6%), and computers and electronic products (+0.1%). Orders for fabricated metals products and electrical equipment both ticked down 0.1%. With unfilled orders continuing to rise, we expect activity to remain positive as companies battle to keep up with demand that has far outpaced supply. One of the most important pieces of today's report, shipments of "core" non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), rose 0.8% in April following strong prints throughout the first quarter. If unchanged in May and June, these orders will be up at a 4.8% annualized pace in Q2 versus the Q1 average, and provides a tailwind to second quarter GDP growth, which is currently tracking around 2% annualized growth following the Q1 GDP decline. Orders for durable goods have seen an extremely sharp recovery, up a combined 66.7% since the April 2020 bottom and now sit 14.6% above the pre-pandemic high set in February 2020. We expect business investment will remain a tailwind for GDP growth throughout 2022 as companies continue to reopen and recover from the severe economic consequences of the COVID shutdowns. In other recent news, the M2 money supply declined 0.4% in April, the first monthly decline for the series since 2010. While this is welcome news, we are concerned it had more to do with a massive Treasury surplus in April than a true shift in monetary policy. Despite the April dip, the M2 money supply is still up 8.0% in the past year and has risen an incredible 41.5% since February of 2020. This money already in the system means inflation is likely to remain elevated this year, next year, and into 2024.