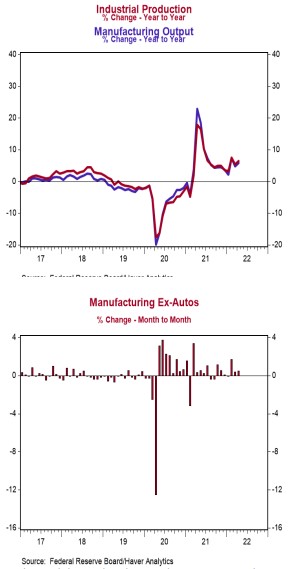

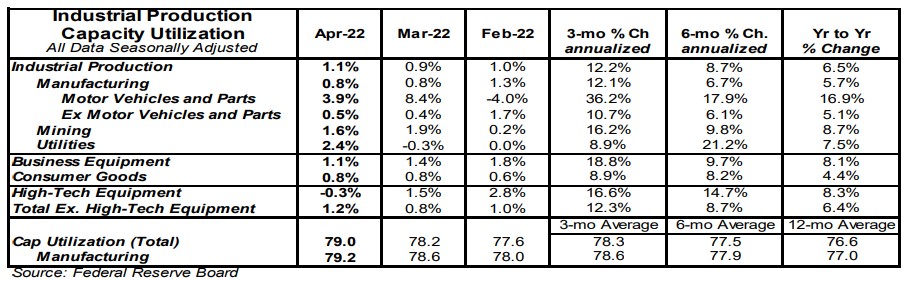

- Industrial production increased 1.1% in April (+1.0% including revisions to prior months), easily beating the consensus expected gain of 0.5%. Utilities output rose 2.4% in April, while mining increased 1.6%.

- Manufacturing, which excludes mining/utilities, increased 0.8% in April. Auto production jumped 3.9%, while non-auto manufacturing rose 0.5%. Auto production is up 16.9% in the past year, while non-auto manufacturing is up 5.1%.

- The production of high-tech equipment declined 0.3% in April but is up 8.3% versus a year ago.

- Overall capacity utilization increased to 79.0% in April from 78.2% in March. Manufacturing capacity utilization rose to 79.2% in April from 78.6%.

Implications:

Industrial activity continued its V-shaped recovery in April, rising for the fourth month in a row, and by more than double consensus expectations. Moreover, the gains in April were broad-based, with nearly every major category posting gains. Looking at the details, manufacturing output was the main contributor to today's headline increase, rising 0.8% to post a third consecutive gain. Notably, a large portion of this came from the volatile auto sector, where activity rose 3.9%. That said, manufacturing outside the auto sector also rose 0.5% in March. Meanwhile, the mining sector (think oil rigs in the Gulf) continued to make strong progress, rising 1.6% in April. We expect continued gains from this sector in the months ahead, with oil prices currently above $110 a barrel for the first time since 2013, incentivizing new exploration. While the Biden Administration had recently announced it would be more flexible on new leases to drill and extract fossil fuels on federal land, it also made headlines recently with high-profile cancellations of leases in both Alaska and the Gulf of Mexico, so government policy continues to look contradictory and unhelpful on the energy front. The good news is that capacity continues to come back online despite this, with Baker Hughes reporting that the total number of oil and gas rigs in operation in the US is rapidly approaching pre-pandemic levels. Finally, the utilities sector, which is volatile from month to month and largely dependent on weather, rose 2.4% in April. Overall, we expect a continued upward trend in industrial production in 2022. Business inventories remain lean, order backlogs are elevated, and demand continues to outstrip supply. For example, this report puts industrial production 4.2% above pre-pandemic levels. Meanwhile, this morning's report on retail sales showed that even after adjusting for inflation, "real" retail sales are up 15.6% over the same period. Ongoing issues with supply chains and labor shortages are hampering a more robust rise in activity, with job openings in the manufacturing sector currently more than double pre-pandemic levels. This mismatch between supply and demand shows why inflation remains uncomfortably high. In other recent manufacturing news, the Empire State Index, a measure of New York factory sentiment, fell unexpectedly to -11.6 in May from +24.6 in April. Notably the 36.2-point decline in May comes on the heels of a 36.4-point surge in April, illustrating abnormally high volatility as the factory sector copes with uncertainty in the aftermath of the invasion of Ukraine and fears of a growth slowdown at home.