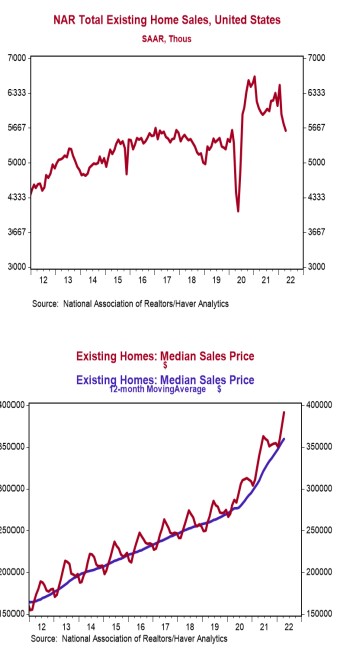

- Existing home sales declined 2.4% in April to a 5.610 million annual rate, narrowly missing the consensus expected 5.640 million. Sales are down 5.9% versus a year ago.

- Sales in April fell in the West and South but rose in the Midwest and Northeast. The drop was due to both single-family homes and condos/co-ops.

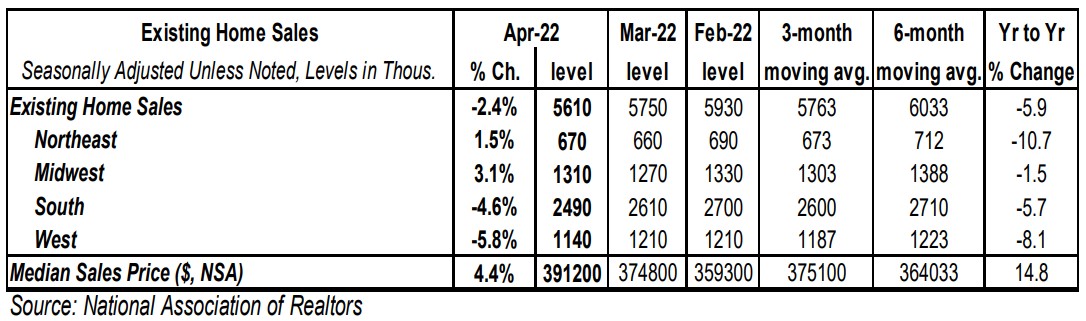

- The median price of an existing home rose to $391,200 in April (not seasonally adjusted) and is up 14.8% versus a year ago. Average prices are up 9.2% versus last year.

Implications:

Existing home sales fell for the third month in a row in April, marking the slowest pace since 2020. Recent volatility shows that the housing market is struggling to find its footing so far in 2022, with falling affordability playing a role. The prime culprit recently has been 30-year mortgage rates, which have already risen roughly 200 basis points since December. On top of that, potential buyers are also dealing with a huge mismatch between supply and demand that has pushed up median prices 14.8% from a year ago. Assuming a 20% down payment, the rise in mortgage rates and home prices since December amount to a 42% increase in monthly payments on a new 30-year mortgage for the median existing home. No wonder sales have slowed down! Although the months' supply of existing homes for sale (how long it would take to sell today's inventory at the current sales pace) rose slightly to 2.2 months in April, inventories are still down 10.4% from a year ago, the best way to look at the data given the seasonality of the housing market. What is really impressive is that despite the lack of options demand remains strong, with buyer urgency so high in April that 88% of existing homes sold were on the market for less than a month. While sales are clearly under pressure, this is not a repeat of 2008/9. We do not foresee a collapse in home sales even with higher mortgage rates, though it is likely that existing home sales wind up moderately lower in 2022 than 2021. More inventory is becoming available (though more slowly than we would like) which will eventually help price gains moderate. Also keep in mind that Millennials are now the largest living generation in the US and have begun to enter the housing market in force, which represents a demographic tailwind for sales for the foreseeable future. In other news this morning, initial unemployment claims rose 21,000 last week to 218,000. Meanwhile, continuing claims fell 25,000 to 1.317 million. While some may lament the minor uptick in layoffs recently, the tight labor market seems to be reabsorbing those on the sidelines at a rapid pace. Overall, these figures are consistent with continued growth in employment in May. Finally, in manufacturing news this morning, the Philadelphia Fed Index, a measure of factory sentiment in that region, fell to 2.6 in May from 17.6 in April.