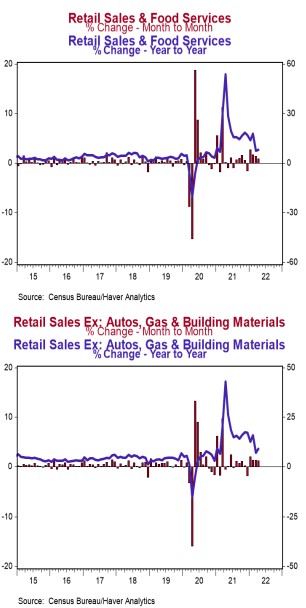

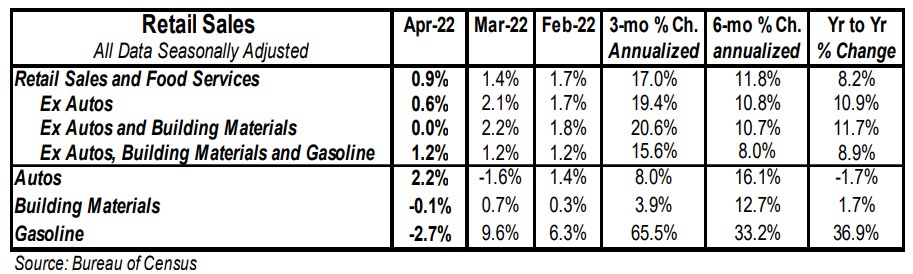

- Retail sales rose 0.9% in April (+1.5% including revisions to prior months) versus a consensus expected a gain of 1.0%. Retail sales are up 8.2% versus a year ago.

- Sales excluding autos rose 0.6% in April (+1.2% including revisions to prior months), beating the consensus expected gain of 0.4%. These sales are up 10.9% in the past year. Excluding gas, sales rose 1.3% in April and are up 5.9% from a year ago.

- The increase in sales in April was led by autos, non-store retailers (internet and mail-order), and restaurants & bars. The largest decline was for gas stations.

- Sales excluding autos, building materials, and gas rose 1.2% in April, and including prior months' revisions were up 1.6%. If unchanged in May/June, these sales will be up at a 10.0% annual rate in Q2 versus the Q1 average.

Implications:

First, the good news. Retail sales grew a robust 0.9% in April and were revised up for March. Nine of the thirteen major sales categories increased in April, led by autos, non-store retailers, and restaurants & bars. The gain in auto sales is a sign that supply-chain issues are gradually easing while the gain in sales at restaurants & bars is a sign of continued progress toward normalcy. "Core" sales, which exclude the most volatile categories of autos, building materials, and gas station sales, rose 1.2% in April, are up 8.9% from a year ago, and up 26.6% versus February 2020. Now, the bad news. One of the key drivers of overall spending is inflation. Yes, consumers are spending more, but they are not taking home the same amount of goods. Adjusted for the consumer price index (CPI), overall retail sales rose 0.6% in April. But, although retail sales are up 8.2% from a year ago, that pace lags inflation, with the CPI up 8.3% over the same period. Due to very loose monetary policy and the massive increase in government transfer payments in response to COVID, retail sales are still running much hotter than they would have had COVID never happened. However, loose monetary policy, which helped finance that big increase in government spending, is translating into high inflation, which is why "real" (inflation-adjusted) retail sales are roughly flat versus a year ago. What to expect in the months ahead? Continued gains in retail sales, but gains that struggle to keep pace with inflation. For example, spending at gas stations fell in April, but is likely to rebound for May because of increases in gas prices. Meanwhile, look for modest overall gains in consumer spending due to the service sector.