View from the Observation Deck

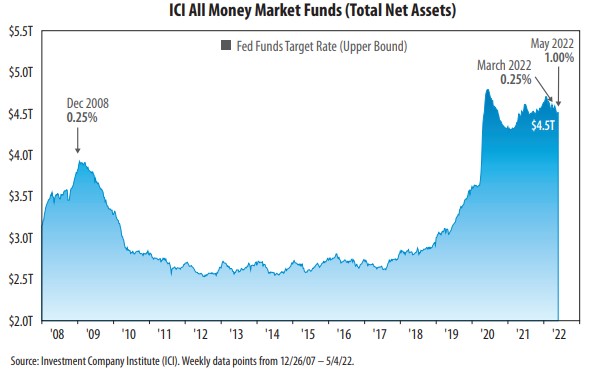

1. U.S. money market fund (MMF) assets totaled $4.51 trillion for the week ended 5/4/22, according to data from the ICI. The all-time high was set on 5/20/20 at $4.80 trillion.

2. We use the federal funds target rate (upper bound) in the chart as a proxy for short-term interest rates, such as those offered by taxable money market funds and other savings vehicles.

3. From March 2020 to March 2022, the Federal Reserve ("Fed") kept the federal funds target rate (upper bound) at 0.25%, according to data from the Fed. The Fed hiked 25 basis points on 3/16/22 and another 50 basis points on 5/4/22, bringing the benchmark lending rate to 1.00%.

4. Fed Chairman Jerome Powell has stated that the Fed is poised to raise the federal funds target rate (upper bound) by 50 basis points at each of its next two meetings (June & July), which would take the rate up to 2.00%. Data from CME Group indicates that current market pricing has the rate rising to 2.75% or 3.00% by year-end. As such, we expect MMF yields to trend higher as well in 2022.

5. The Fed's balance sheet of assets stood at $8.94 trillion on 5/4/22, up significantly from the $2.24 trillion level at the close of December 2008, according to data from Bloomberg. Total MMF assets currently sit approximately $700 billion above where they stood ($3.84 trillion) on 12/31/08. The Fed has stated it will be shrinking its balance sheet by $47.5 billion per month in June, July and August and then by $95 billion per month starting in September.

6. We will continue to monitor cash flows to see how investors respond to the Fed's tightening actions moving forward.