View from the Observation Deck

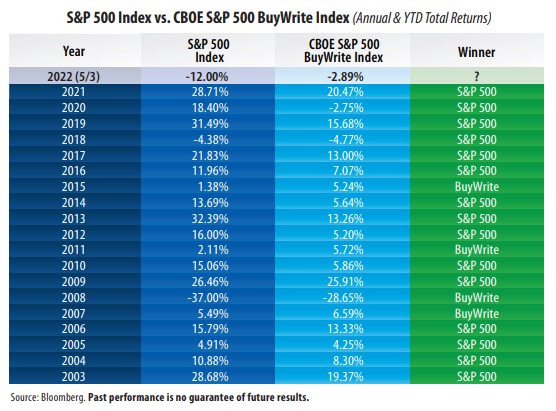

1. From 2003-2021, the CBOE S&P 500 BuyWrite Index (an index designed to measure a covered call strategy) outperformed the S&P 500 Index in just four of the 19 calendar years. We chose 2003 because it was the first year of a new bull market.

2. For comparative purposes, from 1926-2021 (96 years), the S&P 500 Index posted an average annual total return of 10.46%, according to Morningstar/Ibbotson Associates.

3. While covered call options can generate an attractive level of current income, they can also cap the potential for capital appreciation.

4. The use of a covered call portfolio tends to be most beneficial to investors when the stock market posts down years (2008) and when returns range from 0% to 10% (2007, 2011 and 2015), though the BuyWrite Index did not outperform the S&P 500 Index in 2005 or in 2018.

5. Covered call writing tends to be less beneficial when stock market returns are above 10%, such as in 2010, 2012, 2013, 2014, 2016, 2017, 2019 and 2020 (see table). The strategy, however, performed well in 2021.

6. A Bloomberg survey of 24 equity strategists found that their average 2022 year-end price target for the S&P 500 Index was 4,868 as of 4/18/22, according to its own release. The highest and lowest estimates were 5,330 and 4,400, respectively.

7. As of 5/3/22, the S&P 500 Index stood at 4,175.48, which was 12.95% below its all-time high of 4,796.56 set on 1/3/22 and 16.59% below the 4,868 average 2022 price target referenced in point 6, according to Bloomberg.

8. As of 4/29/22, Bloomberg’s consensus estimated year-over-year earnings growth rates for the S&P 500 Index for 2022, 2023 and 2024 were 10.32%, 9.41% and 9.07%,

respectively.

9. Morningstar added Options Trading to its Alternative Funds category in early 2021. Investors funneled a net $4.71 billion into Options Trading mutual funds and exchangetraded funds (ETFs) in Q1’22, according to Morningstar. Net inflows totaled $15.71 billion for the 12-month period ended 3/31/22.

10. The CBOE S&P 500BuyWrite Index has significantly outperformed the S&P 500 Index so far in 2022 (see table). It has not outperformed the S&P 500 Index for a calendar year

since 2015. Stay tuned!