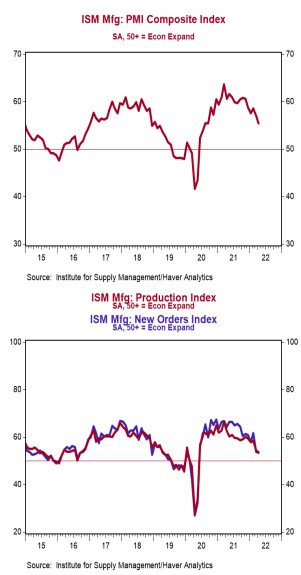

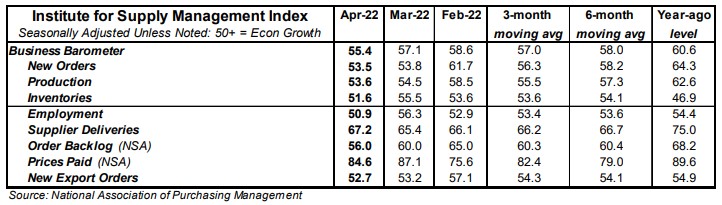

- The ISM Manufacturing Index slowed to 55.4 in April, missing the consensus expected 57.6. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mostly lower in April, but all stand above 50, signaling growth. The production index fell to 53.6 from 54.5 in April, while the new orders index declined to 53.5 from 53.8. The employment index fell to 50.9 from 56.3, and the supplier deliveries index rose to 67.2 from 65.4 in April.

- The prices paid index declined to 84.6 in April from 87.1 in March.

Implications:

The manufacturing sector continued to expand in April, though at a slower pace, with seventeen of eighteen industries reporting growth. The two most forward-looking indices, new orders and production, both posted declines in April. Moreover, both these declines came on the heels of the largest monthly declines for these series since the early days of the COVID pandemic, signaling that customer uncertainty in the aftermath of the Russian invasion of Ukraine remains a problem. That said and most importantly, both indices are still north of 50, signaling growth. Respondent comments in April highlighted strong ongoing demand from customers while also reiterating supply-chain problems related to shortages of key inputs and transportation services. On top of this, the COVID-19 shutdowns in Shanghai were reflected in the comments as well, with gridlock at the ports exacerbating the ongoing issues already mentioned. These issues have all come together to keep manufacturing activity from rising quickly enough to meet an explosion of demand. This was reflected in the supplier deliveries index, which rose in April, though it is still well below its recent high back in May 2021, signaling progress. However, delays are far from over, with sixteen of eighteen industries reporting waiting longer for inputs. This, in turn, has resulted in long lead times for the clients of US factories, who continued to see their inventories shrink in April. The good news is that the rate at which those inventories are shrinking has been slowing consistently. Meanwhile, the employment index gave up ground in April, falling to 50.9 from 56.3 in March. It looks like the manufacturing sector, which is one of the worst-hit sectors in the ongoing labor shortage, is contending with a tight labor market just like everyone else. The good news is that job openings are now down over 100,000 from the peak, but are still twice what they were pre-pandemic, signaling the sector still has a way to go. Finally, the highest reading of any index in April continued to come from prices, which fell slightly to 84.6 but remains very elevated versus history. It looks like the invasion of Ukraine, and now the shutdowns in China, have temporarily boosted inflationary pressure over and above pre-existing inflation related to an overly expansionary Federal Reserve. Inflation this year will ultimately moderate from the pace we saw last year, but not just yet. In other news this morning, construction spending eked out a gain of 0.1% in March ( 1.5% including revisions to prior months), with large increases in home building offsetting declines in commercial construction and manufacturing projects.