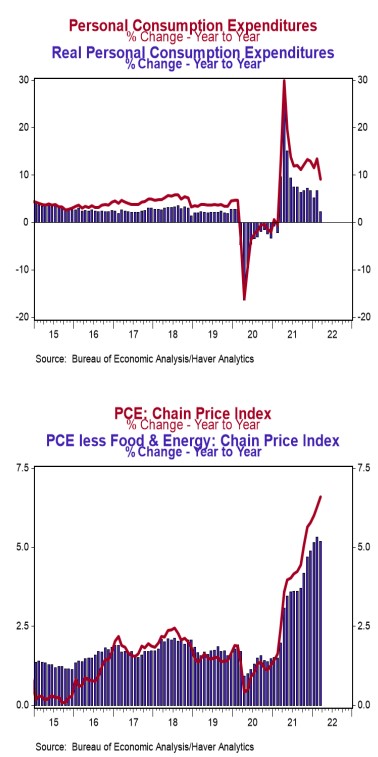

- Personal income rose 0.5% in March ( 0.9% including revisions to prior months), beating the consensus expected 0.4%. Personal consumption rose 1.1% in March ( 0.9% including prior months' revisions), well above the consensus expected 0.6%. Personal income is down 11.6% in the past year, while spending has increased 9.1%.

- Disposable personal income (income after taxes) increased 0.5% in March but is down 14.7% from a year ago.

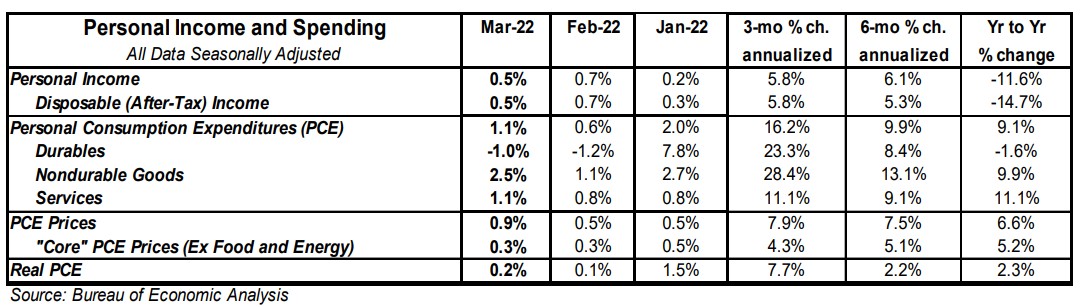

- The overall PCE deflator (consumer prices) rose 0.9% in March and is up 6.6% versus a year ago. The "core" PCE deflator, which excludes food and energy, rose 0.3% in March and is up 5.2% in the past year.

- After adjusting for inflation, "real" consumption rose 0.2% in March, and is up 2.3% from a year ago.

Implications: Incomes and spending continued to rise in March, as the economy progresses back towards fundamental drivers of activity and away from the effects of the temporary and artificial stimulus implemented in 2020-21. Private-sector wages and salaries led the growth in income, up 0.6% in March, while cash in pockets was aided in growth by every major income category. Compared to a year ago, personal income is down 11.6%, but that is entirely due to stimulus checks that were distributed as one-time payments last March. Strip out government transfer payments, and personal income is up 8.6% in the past year, with private-sector wages and salaries up a massive 12.8% over that time. Consumption, meanwhile, rose 1.1% in March and is up 9.1% from a year ago. Diving into the details shows strength in consumption of both goods and services. As COVID restrictions continue to fade, people have gotten back outside to the leisure and travel activities that were hampered for much of the past two years. Since bottoming in April of 2020, consumption has grown at an astronomical 19.3% annualized rate, and spending today stands 14.1% above February 2020 levels. But artificially booming demand, the result of government transfers and rapid growth in the M2 money supply, is not a free lunch. PCE prices, the Fed's preferred measure of inflation, rose 0.9% in March (the largest monthly increase in more than 15 years), and are up 6.6% from a year ago, a pace of inflation not seen since 1982. Core prices, which exclude food and energy, rose 0.3% in March and are up 5.2% from a year ago. By either measure, inflation is far too high. And the ongoing geopolitical conflict in Ukraine isn't helping to ease energy and food price pressures. The Fed is very likely to raise rates 50 basis points at their meeting next week and continue to signal an aggressive stance in raising rates moving forward, but they remain well behind the curve. Monetary policy is becoming less loose, but is still nowhere near tight. In recent news on the manufacturing front, the Kansas City Fed Index fell to a still strong 25 in April from 37 in March, while its counterpart, the Chicago PMI, declined to 56.4 in April from 62.9 in March. Both reports suggest that next week's national ISM reports will show continued growth in the factory sector.