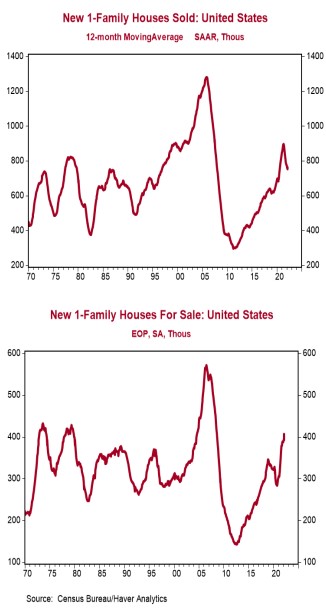

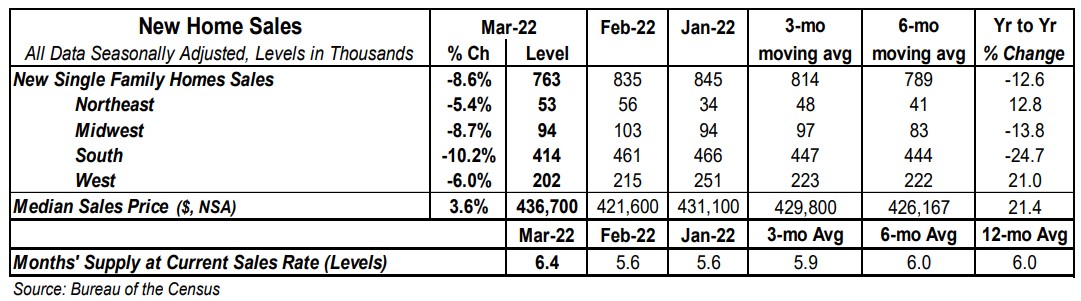

- New single-family home sales declined 8.6% in March to a 0.763 million annual rate, narrowly missing the consensus expected 0.768 million. Sales are down 12.6% from a year ago.

- Sales in March fell in all of the major regions.

- The months' supply of new homes (how long it would take to sell all the homes in inventory) rose to 6.4 in March from 5.6 in February. The gain was due to both a slower pace of sales and a 15,000 unit increase in inventories.

- The median price of new homes sold was $436,700 in March, up 21.4% from a year ago. The average price of new homes sold was $523,900, up 26.3% versus last year.

Implications:

New home sales fell for the third month in a row in March as the housing market continues to struggle to find its footing in the face of declining affordability and a limited inventory of completed homes. While rapidly rising prices have been an issue in the housing market throughout the COVID-19 pandemic, the recent run-up in borrowing costs has been adding to the burden. US 30-year mortgage rates are up roughly 200 basis points since December, sidelining some potential buyers. That said, while demand for housing has probably been falling to some degree due to rising interest rates, it's important to remember that potential purchasers still exceed available supply. This is evident from the fact that median sales price growth has been accelerating again and prices are now up 21.4% from a year ago. The main problem is still that buyers are stuck dealing with very few options when it comes to completed homes. It's true that overall inventories have been rising recently and now sit at the highest level since 2008. This has pushed up the months' supply (how long it would take to sell the current inventory at today's sales pace) to 6.4 from a record low reading of 3.5 in late 2020. However, almost all of this inventory gain is from homes where construction has either not yet started or is still underway. Doing a similar calculation with only completed homes on the market shows a months' supply of a meager 0.6, near the lowest level on record back to 1999. The good news is that builders have been ramping up construction activity to help meet demand, with the total number of single-family homes under construction currently at the highest levels since 2006. Ultimately, that added supply will facilitate more sales while slowing the pace of new home price appreciation. We still expect the market to be able to weather the headwinds of rising mortgage rates in 2022, with sales of new homes either flat or only slightly down versus 2021. In other housing news this morning, home prices soared in February. The national Case-Shiller index rose 1.9% for the month, the fastest pace for any month on record (dating back to 1975); the FHFA index, which measures prices for homes financed with conforming mortgages, rose 2.1% in February, also the fastest pace on record (dating back to 1991). The Case-Shiller index is up 19.8% versus a year ago, with the largest price gains in Phoenix and Tampa and the smallest price gains in Washington, DC and Minneapolis. The FHA index is up 19.5% from a year ago. In part due to higher mortgage rates, we expect home price gains to continue in 2022 but to slow down from the torrid pace so far this year. Finally this morning, the Richmond Fed Manufacturing Index, which measures mid-Atlantic manufacturing sentiment, rose to 14 in April from 13 in March, a signal that the factory sector is still growing.