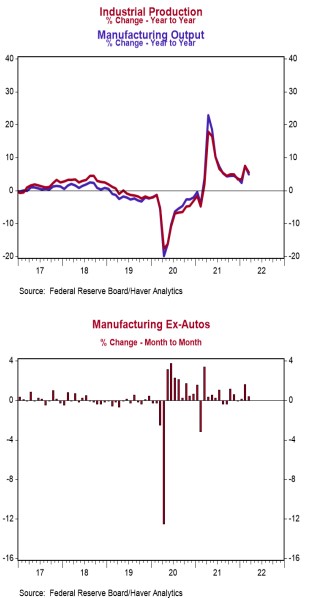

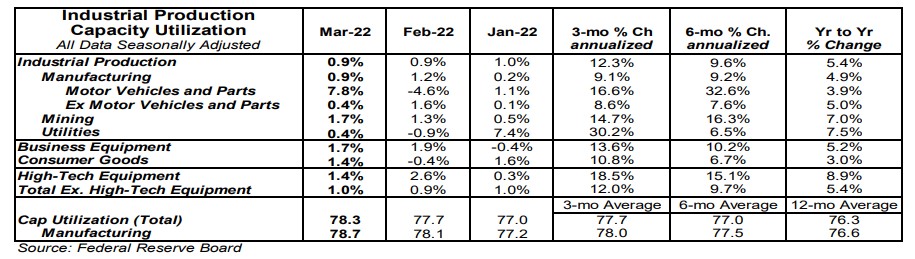

- Industrial production increased 0.9% in March (+1.0% including revisions to prior months), easily beating the consensus expected gain of 0.4%. Utilities output rose 0.4% in March, while mining increased 1.7%.

- Manufacturing, which excludes mining/utilities, increased 0.9% in March. Auto production jumped 7.8%, while non-auto manufacturing rose 0.4%. Auto production is up 3.9% in the past year, while non-auto manufacturing is up 5.0%.

- The production of high-tech equipment rose 1.4% in March and is up 8.9% versus a year ago.

- Overall capacity utilization increased to 78.3% in March from 77.7% in February. Manufacturing capacity utilization rose to 78.7% in March from 78.1%.

Implications:

Industrial activity continued its V-shaped recovery in March, rising for the third month in a row and beating consensus expectations. Moreover, the gains in March were broad-based, with every major category posting gains. Looking at the details, manufacturing output was the main contributor to today's headline gain, rising 0.9%. Notably, most of the gain came from the volatile auto sector, where activity surged 7.8%. That said, manufacturing outside the auto sector also rose 0.4% in March, also posting a third consecutive monthly gain. Meanwhile, the mining sector (think oil rigs in the Gulf) continued to make strong progress, rising 1.7% in March. We expect continued gains from this sector in the months ahead, with oil prices currently above $100 a barrel for the first time since 2014, incentivizing new exploration. Meanwhile, as a result of higher gas prices, the Biden Administration is becoming more flexible on new leases to drill and extract fossil fuels on federal land, which might generate some extra activity in those locations in the next few years. According to Baker Hughes, the total number of oil and gas rigs in operation in the US is still roughly 18% below pre-pandemic levels, a signal that producers still have ground to make up. Finally, the utility sector, which is volatile from month to month and largely dependent on weather, rose 0.4% in March. Overall, we expect a continued upward trend in industrial production in 2022. Business inventories remain lean, order backlogs are elevated, and demand continues to outstrip supply. For example, this report puts industrial production 3.5% above pre-pandemic levels. Meanwhile, last week's report on retail sales showed that even after adjusting for inflation, "real" retail sales are up 13.6% over the same period. Ongoing issues with supply chains and labor shortages are hampering a more robust rise in activity, with job openings in the manufacturing sector currently more than double pre-pandemic levels. This mismatch between supply and demand shows why inflation has accelerated so sharply. In other recent manufacturing news, the Empire State Index, a measure of New York factory sentiment, rebounded sharply to +24.6 in April from -11.8 in March. It looks like the initial negative shock to industry sentiment from the Russian invasion of Ukraine was short lived.