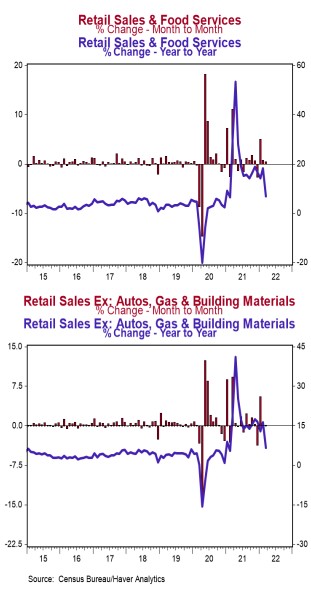

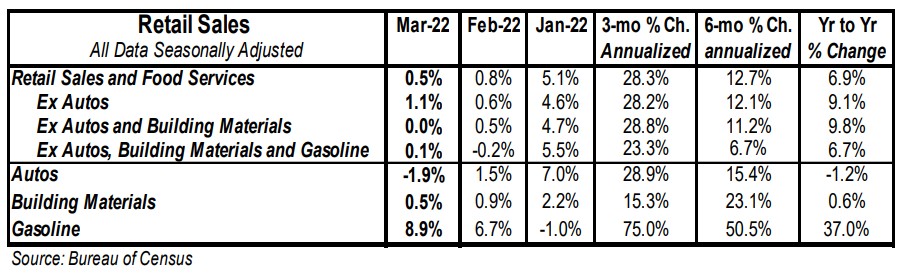

- Retail sales rose 0.5% in March (+1.2% including revisions to prior months). The consensus expected a gain of 0.6%. Retail sales are up 6.9% versus a year ago.

- Sales excluding autos rose 1.1% in March (+1.7% including revisions to prior months). The consensus expected a gain of 1.0%. These sales are up 9.1% in the past year. Excluding gas, sales declined 0.3% in March but are up 4.4% from a year ago.

- The increase in sales in March was led by gas stations and general merchandise stores. The largest declines were for non-store retailers and autos.

- Sales excluding autos, building materials, and gas rose 0.1% in March, and including prior months' revisions were up 0.6%. These sales were up at a 12.0% annual rate in Q1 versus the Q4 average.

Implications:

Retail sales grew very close to consensus expectations for March itself, rising 0.5% for the month. However, including upward revisions to prior months, sales rose 1.2%. Ten of the thirteen major sales categories were up in March, led by gas stations and general merchandise stores. As a result, we estimate real consumer spending on goods and services combined was up at a 3.5 - 4.0% annual rate in Q1. But it’s also clear that inflation is taking an increasing bite out of consumer purchasing power and will be a significant headwind for growth in future consumer spending. It’s important to remember that retail sales are not adjusted for inflation. Sales at gas stations rose 8.9% in March due to higher prices. In fact, average gasoline prices rose by 19.7% in March, or 71 cents per gallon. Adjusted for the consumer price index, overall retail sales declined 0.7% in March. And although retail sales are up 6.9% from a year ago that pace lags inflation, including a CPI up 8.5% from a year ago. In the months ahead, the path of retail sales will be a battle between a number of opposing factors. Rising wages, jobs, and inflation will all be tailwinds for retail sales, while the waning of the temporary and artificial boost from “stimulus” checks and other government benefits will be headwinds. But real (inflation-adjusted) retail sales will struggle while the service sector picks up the slack due to continued re-opening. On the jobs front today, initial unemployment claims increased 18,000 last week to a still very low 185,000, while continuing claims declined 48,000 to 1.475 million. In other news this morning, import prices rose 2.6% in March while export prices increased 4.5%. In the past year, import prices are up 12.5%, while export prices are up 18.8%. Expect prices to continue to trend higher in the months ahead due to the effects of the war in Eastern Europe and the very loose stance of monetary policy. Tomorrow, the Government will release Industrial Production data on Good Friday. Along with many other companies in the US, First Trust will be closed in observance of this sacred day. We will release our Data Watch on Monday after Easter.