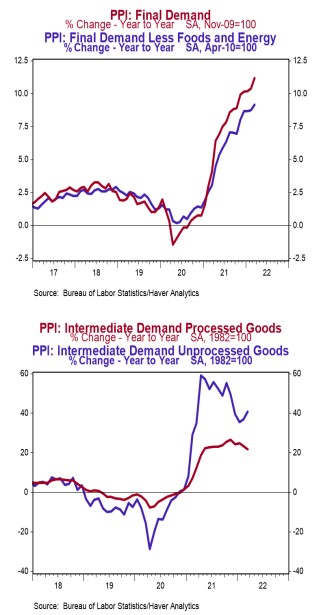

- The Producer Price Index (PPI) rose 1.4% in March, coming in above the consensus expected +1.1%. Producer prices are up 11.2% versus a year ago.

- Energy prices rose 5.7% in March, while food prices increased 2.4%. Producer prices excluding food and energy rose 1.0% in March and are up 9.2% in the past year.

- In the past year, prices for goods are up 15.7%, while prices for services have risen 8.7%. Private capital equipment prices increased 0.8% in March and are up 12.7% in the past year.

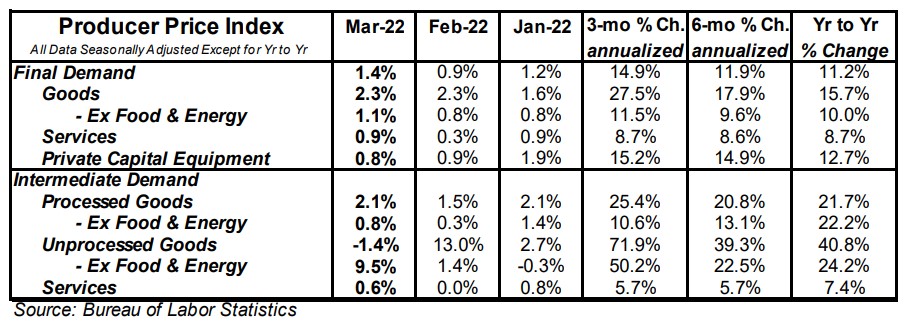

- Prices for intermediate processed goods rose 2.1% in March and are up 21.7% versus a year ago. Prices for intermediate unprocessed goods declined 1.4% in March but are up 40.8% versus a year ago.

Implications:

Producer prices continued to surge in March, rising 1.4% on the back of higher energy costs as impacts from the Russian/Ukraine conflict amplified the large pre-existing inflation pressure created by an overly loose Federal Reserve. Producer prices are now up 11.2% versus a year ago. Looking at the details of the March report, goods prices led the overall index higher, rising 2.3% for the month, as energy – most notably diesel fuel (+20.4%) and home heating (+20.2%) – surged. Food prices rose 2.4% on the month, as higher costs for grains and vegetables were partially offset by a decline in beef costs. Strip out the volatile food and energy categories, and "core" producer prices still rose 1.0% in March, bringing the twelve-month increase in core prices to 9.2%. There was nowhere to hide from inflation in March, as prices for services increased 0.9% as companies looked to pass along higher input costs in the form of padded margins (trade services – which measures the margins received by wholesalers and retailers – rose 1.2% in March). It simply doesn't matter how you cut it, or which inflation gauge you prefer, they all show inflation running far above the Fed's target. While the current war-related spike in inflation readings may moderate in the months ahead, the annual rate of inflation will not come down anywhere close to the Fed's 2% inflation target. Fingers crossed that the Fed has the fortitude to do what is needed to battle inflation in the months ahead, and hopefully those in Washington learn the lesson that their actions have very real (and lasting) consequences.