View from the Observation Deck

1. Companies have a number of ways in which to return capital to their shareholders. Two of the more popular ways in recent years are cash dividends and stock buybacks.

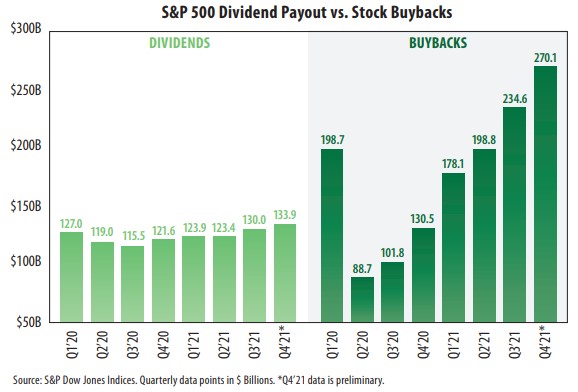

2. Today's blog post shows that both dividend distributions and stock buybacks have set new all-time highs approximately two years after the onset of the COVID-19 pandemic, as measured by the S&P 500 Index.

3. For comparative purposes, we include the dividend distributions and share buybacks for the past eight quarters. Companies are clearly spending more on buybacks than dividends.

4. The all-time high for the S&P 500 Index's quarterly dividend payout was the $133.9 billion distributed in Q4'21, according to data from S&P Dow Jones Indices.

5. The record for quarterly stock buybacks was the $270.1 billion registered in Q4'21, according to data from S&P Dow Jones Indices.

6. As of 12/31/21, the S&P 500 Index sectors contributing the most to its total dividend payout were as follows: Information Technology (17.3%); Health Care (15.0%); Financials (14.3%); and Consumer Staples (10.8%), according to S&P Dow Jones Indices.

7. As of Q4'21, the S&P 500 Index sectors that were most aggressive in repurchasing their stock were as follows (% of all stocks repurchased): Information Technology (27.7%); Financials (19.1%); Communication Services (16.0%); and Consumer Discretionary (11.4%), according to S&P Dow Jones Indices.

8. Overall, the companies in the S&P 500 Index are flush with cash. Cash holdings currently total $1.9 trillion, well above the $1.5 trillion held at the end of 2019 (pre-pandemic), according to Truist. S&P 500 Index companies spent a record high $881.7 billion on stock buybacks in 2021. Goldman Sachs sees buybacks hitting $1 trillion in 2022.