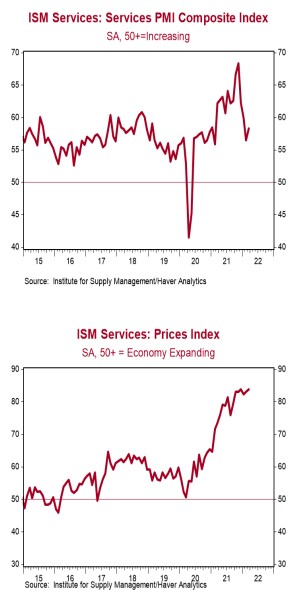

- The ISM Non-Manufacturing index increased to 58.3 in March, slightly below the consensus expected 58.5. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity moved mostly higher in March, and all stand comfortably above 50, signaling growth. The new orders index rose to 60.1 from 56.1, while the employment index rose to 54.0 from 48.5. The business activity index ticked up to 55.5 from 55.1, while the supplier deliveries index dropped to 63.4 from 66.2.

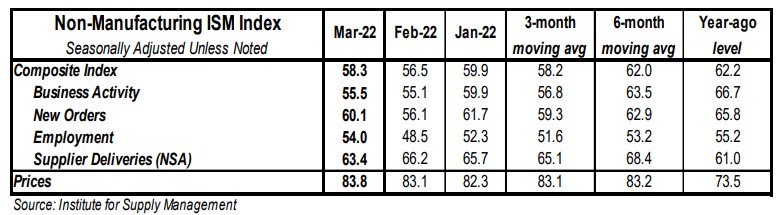

- The prices paid index ticked up to 83.8 in March from 83.1 in February.

Implications:

The service sector continued to expand rapidly in March, with the index rising to 58.3 for the month, reversing a string of declines since the index peaked at an all-time high in November 2021. Gains were broad-based, with seventeen of eighteen industries reporting growth. Survey comments continue to cite supply chain challenges surrounding inflation, material shortages, and extended lead times as problems businesses face when fighting to meet the explosion of demand since our economy began re-opening. Most notably, one survey respondent from the Accommodation & Food Services industry wrote that employment has improved, and restaurant activity has picked up with the rapid decline in COVID cases and removal of related mask and vaccine mandates. This improvement can be clearly seen in the employment index, which jumped back into expansion territory to 54.0 from 48.5 in February. More good news can be seen in the two most forward-looking indexes, new orders and business activity, which both posted gains for the month and remain well in expansion territory. Meanwhile, the inventories index expanded for the second straight month, suggesting businesses are starting to finally re-stock their shelves. Last, the highest reading of any index continues to come from prices, which increased to 83.8 and remains less than a point below its record high set last December. All 18 industries reported paying higher prices for materials in March. No matter what measure you prefer, inflation is high, and it looks like the invasion of Ukraine temporarily boosted inflationary pressure over and above the pre-existing level related to an overly expansionary Federal Reserve. Inflation will eventually subside from this war-related spike, but it will remain elevated longer than the bond market expects.