View from the Observation Deck

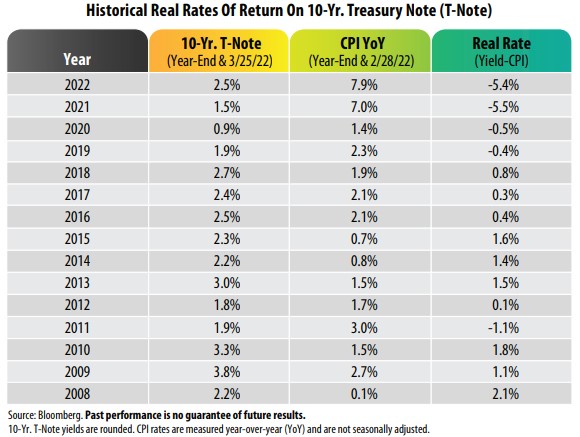

1. The real rate of return on a bond is calculated by subtracting the most recent inflation rate, such as the Consumer Price Index (CPI), from the bond's current yield. The higher the real rate the better.

2. As of the close on 3/25/22, the yield on the benchmark 10-year T-note was 2.47% (2.5% rounded), well below the 7.9% trailing 12-month rate on the CPI in February 2022. That equates to a real rate of -5.4%, which is not attractive.

3. In addition, the real rate was little changed from the end of 2021 despite the yield on the 10-year T-note spiking by approximately 100 basis points over the period. The CPI nearly matched the 100 basis point move.

4. At a base level, in order to maintain one's purchasing power, bond investors have sought to generate a yield that at least outpaces the rate of inflation.

5. For comparative purposes, from 3/25/92 through 3/25/22 (30 years), the average yield on the 10-year T-note was 3.99% (4.0% rounded), while the average rate on the CPI stood at 2.4% (2/28/92-2/28/22), according to Bloomberg. Those figures translate into an average real rate of return of 1.6%, far more attractive than currently available. These would be considered normalized yields/rates, in our opinion.

6. On 3/16/22, the Federal Reserve ("Fed") initiated a 25 basis point hike in the federal funds rate. The median Fed official is signaling another six hikes, totaling 150 basis points, through year-end, according to Brian Wesbury, Chief Economist at First Trust Advisors L.P. That would equate to 175 basis points in aggregate. The Fed also signaled it could raise rates an additional 75-100 basis points in 2023.

7. To illustrate just how fast things can change, Fed Chairman Jerome Powell announced on 3/21/22 that the Fed is willing to raise interest rates "faster than expected," and high enough to curb growth and hiring, if it deems it necessary to slow surging inflation, according to U.S. News & World Report.

8. With respect to the Fed’s $9 trillion balance sheet, Powell announced last week that the Fed intends to begin paring it down as soon as May, according to Reuters. Wesbury expects the Fed to reduce it by $75 billion to $100 billion per month. The Fed has been buying Treasuries and mortgage-backed securities on and off since the 2008-2009 financial crisis to keep bond yields artificially low.