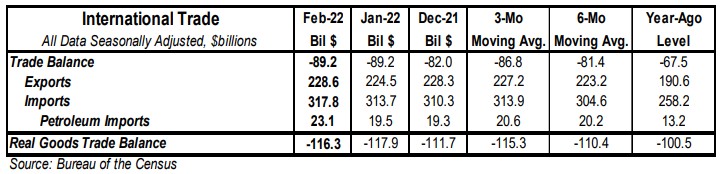

- The trade deficit in goods and services was essentially unchanged, coming in at $89.2 billion in February, larger than the consensus expected $88.5 billion.

- Exports rose by $4.1 billion, led by an increase in pharmaceuticals and fuel oil. Imports rose $4.1 billion, led by crude oil, other chemicals, and other petroleum products.

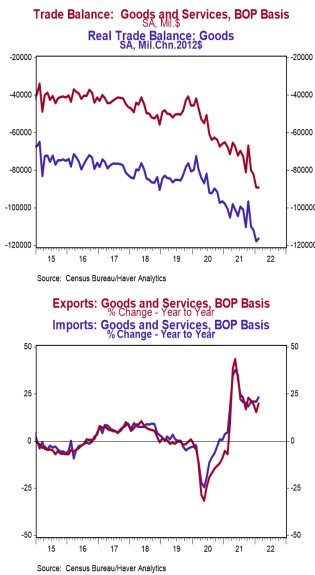

- In the last year, exports are up 19.9% while imports are up 23.1%.

- Compared to a year ago, the monthly trade deficit is $21.7 billion larger; after adjusting for inflation, the “real” trade deficit in goods is $15.8 billion larger than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications:

The trade deficit was essentially unchanged in February at $89.2 billion, as both exports and imports increased by $4.1 billion. We like to follow the total volume of trade (imports plus exports), which signals how much businesses and consumers interact across the US border. That measure rose by $8.2 billion in February, is up 21.8% versus a year ago, and sits at record highs. In general, the trend increase in the total volume of trade signals recovery from COVID-19. Expect the trade deficit to remain volatile from month to month but generally stay large in the months ahead as the US has recovered from the coronavirus faster than most other countries. In addition, Russia’s invasion of Ukraine may affect trade patterns for March and beyond. Given massive and artificial government stimulus in the US, both fiscal and monetary, the demand for imports should continue to outstrip the demand for exports to the rest of the world. Also, the US is still running low on inventories for many goods due to the surge in consumer spending. That means the appetite for imports will remain much stronger than normal as companies try to restock their shelves and warehouses. Supply-chain problems are still a big issue as ports remain overwhelmed in the US, and the tragic war in Ukraine, it is only adding to the problem. For example, the ports of Los Angeles and Long Beach currently have 33 container ships waiting to be unloaded, although this is a new recovery low, its well above the 0-1 normal level experienced pre-COVID. Also in today’s report, for the 8th month in a row, the dollar value of US petroleum imports exceeded US petroleum exports. Although the petroleum trade deficit is still small compared to prior decades, this is a reversal from 2020 when the US was exporting more petroleum products than it was importing.