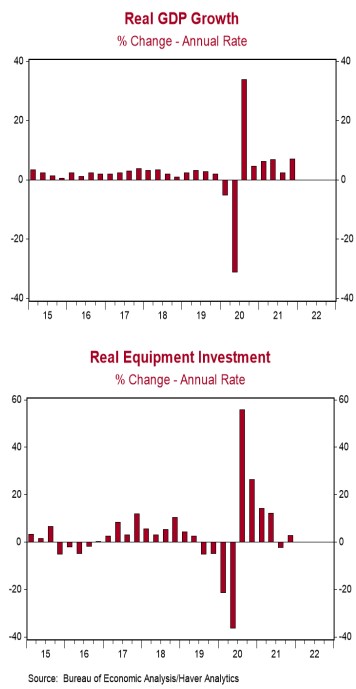

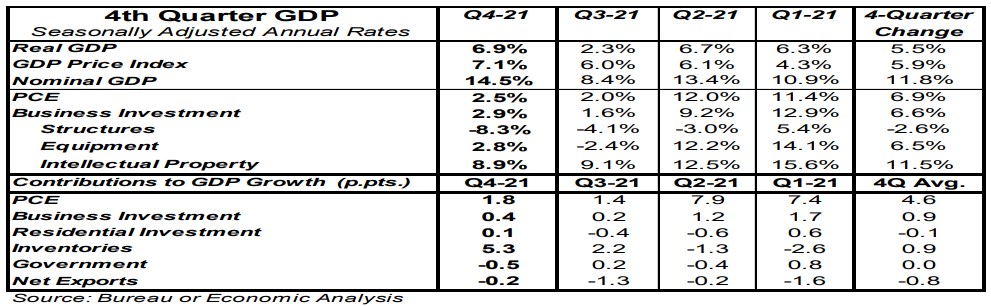

- Real GDP growth in Q4 was revised slightly lower to a 6.9% annual rate from a prior estimate and consensus expected of 7.0%.

- Downward revisions to personal consumption, net exports, and business investment more than offset upward revisions to inventories and residential investment.

- The largest positive contributions to the real GDP growth rate in Q4 were inventories and consumer spending. The weakest component was government purchases.

- The GDP price index remained at a 7.1% annual growth rate. Nominal GDP growth – real GDP plus inflation – was revised lower to a 14.5% annual rate from a prior estimate of 14.6%.

Implications:

Real GDP grew at a 6.9% annual rate in the fourth quarter, a slight downward revision from the prior estimate of 7.0%. As a result, real GDP was up 5.5% in 2021 (Q4/Q4), still the fastest growth for any calendar year since the Reagan Boom in 1984. The slight downward revision to the overall number in Q4 was due mainly to a downward revision to consumption. This, along with other small downward revisions to net exports and business investment more than offset the positive revisions to inventories and residential investment. Most of the growth in Q4 itself was due to a much faster pace of inventory accumulation, which will not be repeated in 2022. And in spite of rapid growth in 2021, real GDP finished the year only up at a 1.6% annual rate since the end of 2019, which is slower than the pre-COVID trend. In other words, the US economy is still smaller than it would have been if COVID and the related lockdowns had never happened. Unlike the Reagan Boom or other periods of robust economic growth, the growth in 2021 was artificially boosted by massive government spending and a recovery from the most draconian period of COVID restrictions in 2020. But do you know what’s clearly higher than the pre-COVID trend? Inflation. GDP prices rose at a 7.1% annual rate in Q4 and 5.9% in all of 2021 (Q4/Q4), the largest annual gain since 1981. Since 2019, GDP prices are up an average of 3.6% per year, which, unlike real GDP, is clearly above trend. Combining real GDP growth and inflation gives us nominal GDP, which is up at a 5.2% annual rate since right before COVID, very close to the pre-COVID trend. Today we also got our first look at economy-wide Q4 corporate profits, which grew 0.7% compared to the third quarter and are up 21.0% from a year ago. Most of the gain in Q4 was due to profits from the rest of the world. Profits at domestic non-financial companies also rose, while profits fell slightly at domestic financial firms. Our capitalized profits model suggests US equities remain cheap for now. Plugging the current 10-year treasury yield of 2.40% into our model, fair value for the S&P 500 is around 5325. To get to fair value today, assuming no more profit growth from Q4, the 10-year would have to rise to 2.8%. In other news this morning, the ADP Employment index showed 455,000 private-sector jobs gained in March. We will make our final call on Friday's employment report after we see tomorrow’s report on jobless claims, but it looks like another strong month for job growth in April. In other recent news, home prices continued to surge in January, with both the Case-Shiller national home price index and the FHFA index up 1.6% for the month. The Case-Shiller index is up 19.2% from a year ago while the FHFA index, which measures prices for homes financed with conforming mortgages, is up 18.3%. The gains in the past twelve months have been led by Phoenix and Tampa, with the slowest price gains in Washington, DC and Minneapolis. Look for price gains to continue this year but for the speed of the gains to slow down as the year progresses.