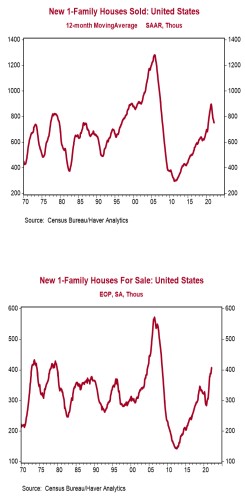

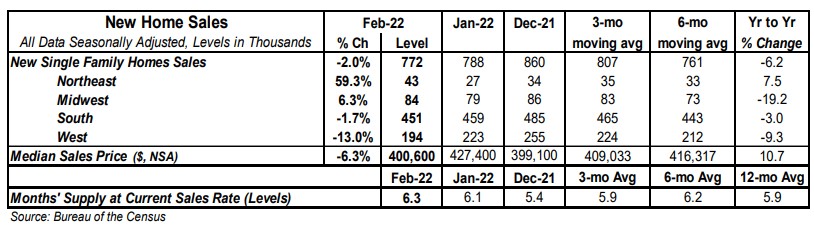

- New single-family home sales declined 2.0% in February to a 0.772 million annual rate, below the consensus expected 0.810 million. Sales are down 6.2% from a year ago.

- Sales in February fell in the West and South but rose in the Northeast and Midwest.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) rose to 6.3 in February from 6.1 in January. The gain was due to both a slower pace of sales and a 9,000 unit increase in inventories.

- The median price of new homes sold was $400,600 in February, up 10.7% from a year ago. The average price of new homes sold was $511,000, up 25.4% versus last year.

Implications:

New home sales fell for the second month in a row in February as the housing market continues to struggle to find its footing in the face of limited supply and higher prices. Purchases of new homes remain well below the peak we saw in early 2021. Why? We think for two main intertwined reasons: a lack of supply of completed homes plus rapid price appreciation versus pre-COVID levels. The good news is that builders have been ramping up activity, with the total number of single-family homes under construction currently at the highest levels since 2006. Ultimately, that added supply will facilitate more sales while slowing the pace of new home price appreciation. In the meantime, buyers are still stuck dealing with very few options when it comes to completed homes. It's true that overall inventories have been rising recently and now sit at the highest level since 2008. This has pushed up the months’ supply (how long it would take to sell the current inventory at today’s sales pace) to 6.3 from a record low reading of 3.5 in late 2020. However, almost all of this inventory gain is from homes where construction has either not yet started or is still underway. Doing a similar calculation with only completed homes on the market shows a months’ supply of a meager 0.5, near the lowest level on record back to 1999. One piece of good news for buyers is that median price growth has begun to decelerate, falling to a year-over-year gain of 10.7% in February after peaking at 24.2% last August. When paired with the strong demand for housing we are currently seeing, we ultimately expect the market to be able to weather the headwinds of rising mortgage rates in 2022. In other recent news, the Richmond Fed Manufacturing Index, which measures mid-Atlantic manufacturing sentiment, surged to +13 in March from +1 in February, a signal that the factory sector is still growing.