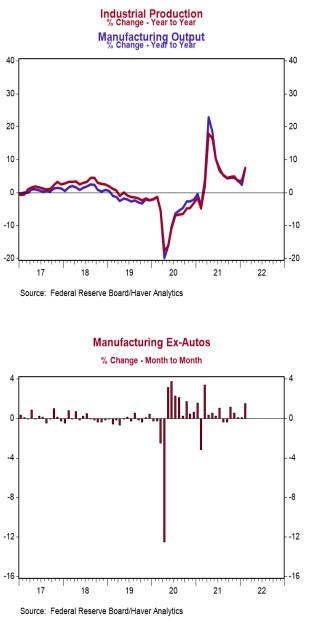

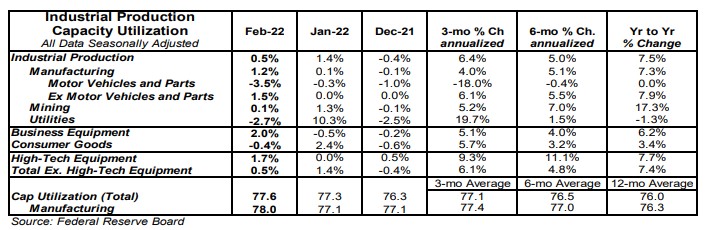

- Industrial production increased 0.5% in February, matching consensus expectations. Utilities output fell 2.7% in February, while mining increased 0.1%.

- Manufacturing, which excludes mining/utilities, increased 1.2% in February. Auto production fell 3.5%, while non-auto manufacturing rose 1.5%. Auto production is unchanged in the past year, while non-auto manufacturing is up 7.9%.

- The production of high-tech equipment rose 1.7% in February and is up 7.7% versus a year ago.

- Overall capacity utilization increased to 77.6% in February from 77.3% in January. Manufacturing capacity utilization rose to 78.0% in February from 77.1%.

Implications:

Industrial activity continued its V-shaped recovery in February, posting a second gain on the heels of January’s increase which was the strongest in nearly a year. Looking at the details, manufacturing output was the main contributor to today’s headline gain, rising 1.2%. Notably, all of the gains came from manufacturing outside the auto sector, where activity rose 1.5%. Auto manufacturing continued to be a headwind, falling for the third month in a row, showing that supply-chain issues like the shortage of semiconductors remain a problem. Meanwhile, the mining sector (think oil rigs in the Gulf) posted a tepid 0.1% gain in February. We expect stronger gains from this sector in the months ahead, with oil prices currently above $100 a barrel for the first time since 2014. According to Baker Hughes, the total number of oil and gas rigs in operation in the US is still roughly 16% below pre-pandemic levels. Finally, the utility sector, which is volatile from month to month and largely dependent on weather, fell 2.7% in February. This was expected following January’s gain, which was the largest for this category since records started in 1939. Overall, we expect a continued upward trend in industrial production in 2022. Business inventories remain lean, order backlogs are elevated, and demand continues to outstrip supply. For example, today’s gain puts industrial production 2.3% above pre-pandemic levels. Meanwhile, yesterday’s report on retail sales showed that even after adjusting for inflation, “real” retail sales are up 14.1% over the same time period. Ongoing issues with supply chains and labor shortages are hampering a more robust rise in activity, with job openings in the manufacturing sector currently more than double pre-pandemic levels. This mismatch between supply and demand shows why inflation has accelerated so sharply. Finally, in other manufacturing news this morning, the Philadelphia Fed Index, a measure of factory sentiment in that region, surged to +27.4 in March from +16.0 in February.