View from the Observation Deck

1. The yield on the 10-year Treasury note (T-note) closed at an all-time low of 0.51% on 8/4/20, according to Bloomberg.

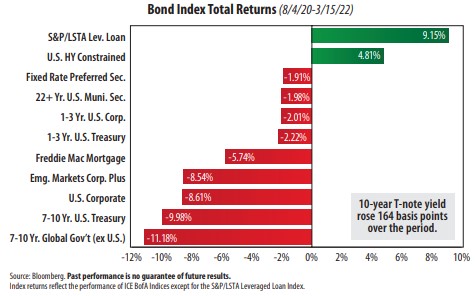

2. From 8/4/20 through 3/15/22, its yield rose from 0.51% to 2.15%, or an increase of 164 basis points. The 2.15% closing yield on 3/15/22 was the highest for the period.

3. As indicated in the chart above, the worst-performing bond categories for the period all track high-grade debt.

4. Since 8/4/20, investors have favored speculative-grade bonds over investment-grade debt, as evidenced by the strong total returns posted by leverage loans (senior loans) and high yield corporate bonds.

5. Emerging market bonds and intermediate-term global government bonds were deep into negative territory for the period captured in the chart. The strength

in the U.S. dollar definitely had a negative impact on the performance of foreign bonds. The U.S. Dollar Index (DXY) rose by 6.13% over the same period, according to Bloomberg.

6. Inflation has surged. The trailing 12-month CPI (Consumer Price Index) stood at 7.9% in February 2022, up from 1.7% a year earlier. The CPI is at a level not seen since 1982, according to data from the Bureau of Labor Statistics.

7. On 3/16/22, the Federal Reserve (“Fed”) initiated a 25 basis point hike in the federal funds rate. The median Fed official is signaling another six hikes, totaling 150 basis points, through year-end, according to Brian Wesbury, Chief Economist at First Trust Advisors L.P. That would equate to 175 basis points in aggregate.

The Fed also signaled it could raise rates an additional 75-100 basis points in 2023.