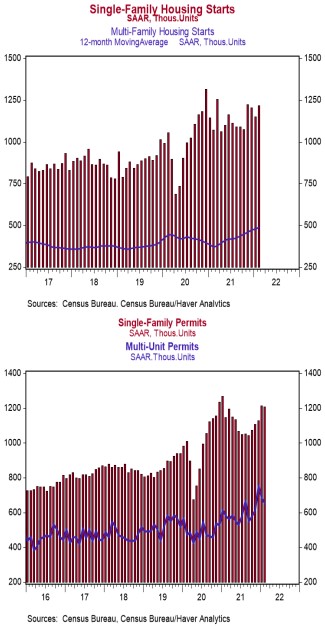

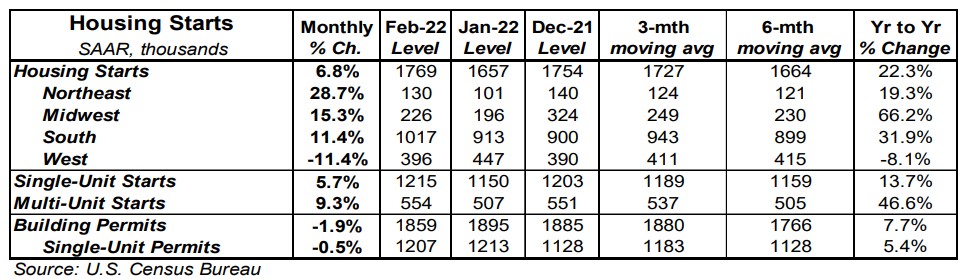

- Housing starts increased 6.8% in February to a 1.769 million annual rate, easily beating the consensus expected 1.700 million. Starts are up 22.3% versus a year ago.

- The gain in February was due to both single-family and multi-family starts. In the past year, single-family starts are up 13.7% while multi-unit starts are up 46.6%.

- Starts in February rose in the Northeast, Midwest, and South, but fell in the West.

- New building permits declined 1.9% in February to a 1.859 million annual rate, narrowly beating the consensus expected 1.850 million. Compared to a year ago, permits for single-family units are up 5.4% while permits for multi-family homes are up 12.2%.

Implications:

After unusually cold weather and rising COVID cases held home building back in January, new home construction rebounded in February, posting the fourth gain in the past five months to hit the fastest pace in nearly sixteen years. Looking at the details of the report, both single and multi-family construction contributed to the headline gain of 6.8%. Notably, multi-family construction is up 46.6% in the past year, outpacing the 13.7% gain for single-family homes. It looks like developers have been shifting resources toward apartment buildings in response to rapidly rising rents and people moving back into big cities as pandemic-era restrictions are removed. Zillow estimates that rental costs for new tenants are up 17.0% in the year ending February 2022 while Apartmentlist.com estimates they have risen 17.6% over the same period, easily exceeding typical gains in the 3.0–4.0% range. Recent distributional effects aside, housing construction remains healthy, with the number of homes under construction at the highest level since 1973, a testament to not only high housing demand but also a slower construction process due to a lack of workers. In addition, builders still have a huge number of permitted projects sitting in the pipeline waiting to be started. In fact, the backlog of projects that have been authorized but not yet started is currently the highest since the series began back in 1999. Given this context, it’s not surprising that permits for new building projects fell 1.9% in February. With plenty of future building activity in the pipeline, builders looking to boost the near record-low levels of inventory to satisfy buyers, and as more Millennials finally enter the housing market, it looks very likely construction will continue its upward trend. Keep in mind the US needs roughly 1.5 million housing starts per year based on population growth and scrappage (voluntary knockdowns, natural disasters, etc.), and 2021 was the first year in the aftermath of the 2008/9 recession that has crossed that threshold. We currently expect 2022 to exceed that benchmark as well. In other recent housing news, the NAHB Housing Index, which measures homebuilder sentiment, declined slightly to 79 in March from 81 in February. While this is the lowest reading in six months, it’s important to remember that these readings remain near historical highs, still signaling robust optimism from developers. In employment news this morning, initial unemployment claims declined 15,000 last week to 214,000. Meanwhile, continuing claims fell 71,000 to 1.419 million, a new post-pandemic era low.