View from the Observation Deck

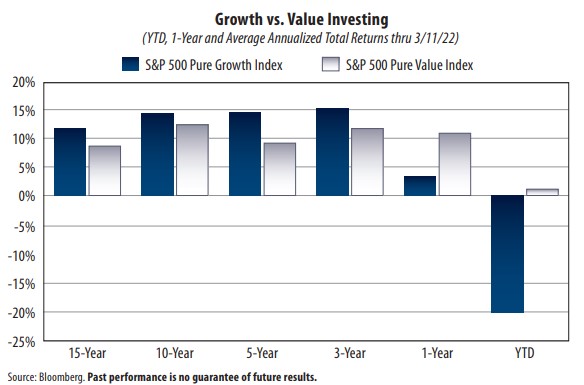

1. We update this post every few months so that investors can see which of the two styles (growth or value) are delivering better results.

2. The most recent results show that value stocks are outperforming growth stocks significantly on a 1-year and year-to-date basis.

3. Having said that, the S&P 500 Pure Growth Index outperformed its value counterpart in four of the six periods featured in the chart above.

4. The total returns through 3/11/22 were as follows (Pure Growth vs. Pure Value): 15-year avg. annual (11.77% vs. 8.63%); 10-year avg. annual (14.37% vs.

12.35%); 5-year avg. annual (14.47% vs. 9.15%); 3-year avg. annual (15.25% vs. 11.69%); 1-year (3.33% vs. 10.88%); and year-to-date (-20.44% vs. 1.11%).

5. As of 2/28/22, the largest sector weighting in the S&P 500 Pure Growth Index was Information Technology at 35.4%, according to S&P Dow Jones Indices. The

largest sector weighting in the S&P 500 Pure Value Index was Financials at 32.1%.

6. From 12/31/21 through 3/11/22 (YTD), the S&P 500 Information Technology Index posted a total return of -17.23%, compared to -6.75% for the S&P 500

Financials Index, according to Bloomberg. The S&P 500 Index was down 11.53% over the same period.

7. Value stocks have tended to outperform growth stocks when the yield on the benchmark 10-year Treasury note (T-note) rises, and vice versa. In the current

climate, the yield on the 10-year T-note is rising.

8. From 12/31/21-3/11/22 (YTD), the yield on the 10-year T-note rose sharply from 1.51% to 2.00%, or 49 basis points, according to Bloomberg. As noted in

point #4, year-to-date through 3/11/22, the S&P 500 Pure Value Index posted a total return of 1.11%, compared to -20.44% for the S&P 500 Pure Growth

Index. The S&P 500 Pure Value Index return has been bolstered some by its exposure to energy and utilities. They are the only sectors that have outperformed

financials so far in 2022.