View from the Observation Deck

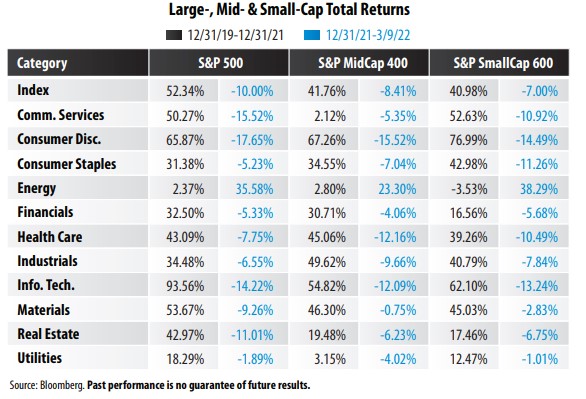

1. All three S&P stock indices in the table above recently dipped into correction territory. The returns in blue ink reflect year-to-date total returns.

2. A correction is usually defined as a 10.00% to 19.99% decline in the price of a security or index from its most recent peak. A bear market is defined as a 20.00% or greater decline in the price of a security or index.

3. As of the close on 3/9/22, the S&P 500 Index stood 10.81% below its all-time closing high, according to Bloomberg. The S&P MidCap 400 and S&P SmallCap 600

Indices stood 10.77% and 11.24% below their respective all-time highs.

4. The three major indices featured in the table comprise the S&P Composite 1500 Index, which represents approximately 90% of total U.S. equity market capitalization

(cap), according to S&P Dow Jones Indices.

5. Large-cap stocks performed significantly better than their mid-and small-cap counterparts from 2020-2021 (black columns). YTD through 3/9/22, large-caps have

lagged the performance of mid-and small-caps (see table above). From 12/31/19 through 3/9/22 (the period covered in the table that captures the COVID-19 pandemic),

the S&P 500, S&P MidCap 400, and S&P SmallCap 600 Indices posted cumulative total returns of 37.16%, 29.88%, and 31.26%, respectively, according to Bloomberg.

6. Sector performance can vary widely by market cap (see table). A couple of the more extreme cases (2020-2021) include Information Technology, Real Estate and

Utilities.

7. As of the close on 3/9/22, the percentage of stocks in the S&P 500, S&P MidCap 400, and S&P SmallCap 600 Indices trading above their 50-day moving averages were

27%, 32% and 36%, respectively.

8. The percentage of stocks in the S&P 500, S&P MidCap 400, and S&P SmallCap 600 Indices trading above their 200-day moving averages were 38%, 37%, and 34%,

respectively.

9. Moving averages tend to smooth out day-to-day price fluctuations and can be a useful tool for traders and investors to identify both positive trends and reversals, in

our opinion.