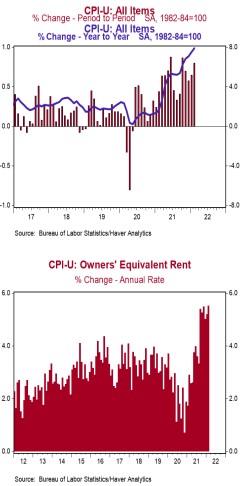

- The Consumer Price Index (CPI) increased 0.8% in February, matching consensus expectations. The CPI is up 7.9% from a year ago.

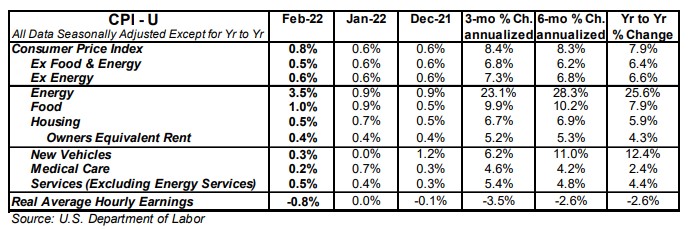

- Energy prices increased 3.5% in February, while food prices increased 1.0%. The “core” CPI, which excludes food and energy, rose 0.5% in February, matching consensus expectations. Core prices are up 6.4% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – declined 0.8% in February and are down 2.6% in the past year. Real average weekly earnings are down 2.3% in the past year.

Implications:

Consumer prices continued to soar in February, rising 0.8% for the month, and pushing the 12-month increase to 7.9%, the largest in more than 40 years. Yes, the energy index was the largest contributor to the headline increase. The 6.6% increase in the gasoline index accounted for nearly a third of the overall move in the CPI. Yes, we expect energy to be a massive contributor for March given the recent spike in oil prices. But no, the inflation we see today is not because of Russia. High inflation was here before the war, and it is likely it will stay at a persistently high level long after. Inflation was broad-based in February, with shelter, food, and airline fares also leading the way. The food index increased 1.0%, on the backs of higher costs for all six major grocery store food groups. Stripping out the typically volatile energy and food components, “core” prices still rose 0.5% for the month, and are up 6.4% in the past year, which is also another multi-decade high. Housing rents (for both actual tenants and the rental value of owner-occupied homes) continue to drive core inflation, rising 0.5% for the month, and accounting for nearly 40% of the core increase. We expect rents to be a key driver for inflation in 2022 because they make up more than 30% of the overall CPI, and still have a long way to go to catch up to home prices, which have skyrocketed 31% since COVID started. For some perspective, housing rents are up only 5.4% in that same timeframe. Other notable movers in today’s report were prices for airline fares (+5.2%) and hotels/motels (+2.5%), which both could be signaling an easing of COVID fears as cases and mandates across the country continue to dwindle. It’s important to recognize the inflation experienced today is not merely a rebound from the steep price declines in 2020 when COVID first hit the US; consumer prices are up at a 4.7% annual rate since February 2020 and core prices are up 3.8%, both well above the Fed’s long-term inflation target of 2.0%. As the massive 42% increase in the money supply continues to gain traction, inflation will be a key indicator to watch in 2022 and beyond. In other news this morning, initial unemployment claims increased 11,000 to 227,000 last week, and continuing claims rose 25,000 to 1.494 million. We expect continued job growth in February and for the rest of 2022.