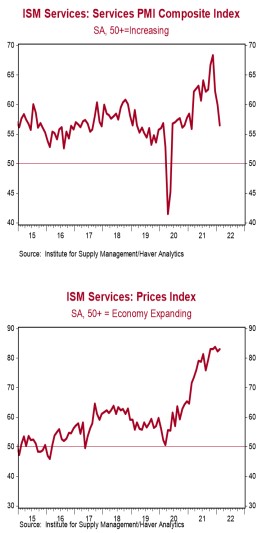

- The ISM Non-Manufacturing index declined to 56.5 in February, below the consensus expected 61.1. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity moved mostly lower in February, but nearly all stand above 50, signaling growth. The new orders index fell to 56.1 from 61.7, while the business activity index declined to 55.1 from 59.9. The supplier deliveries index ticked up to 66.2 from 65.7, while the employment index dropped to 48.5 from 52.3.

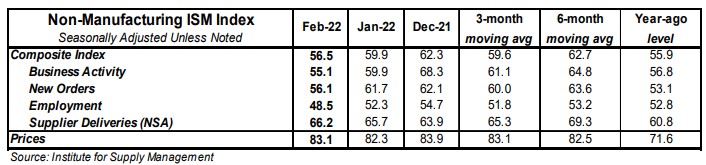

- The prices paid index rose to 83.1 in February from 82.3 in January.

Implications:

The service sector continued to expand rapidly in February, albeit at a slightly slower pace, as rising inflation, labor shortages, and supply chain restraints continue to prevent activity from expanding even more quickly. Gains were broad-based, with fourteen of eighteen industries reporting growth. However, most major components moved lower, with both the new orders and business activity indices continuing to trend downward from their record-setting pace in November. Survey comments continue to cite inflation, labor shortages, and supply chain disruptions as problems their businesses face when fighting to meet the explosion of demand that has happened since our economy began reopening. Notably, one comment wrote “The Great Resignation is real,” as employees quit their jobs in droves, looking for opportunities that pay more and offer more flexible work. This issue can be clearly seen in the employment index, which moved back into contraction territory in February. The other persistent issue – inflation – is also shown in the prices index, which increased to 83.1 and remains less than a point below its record high set last December. Despite these persistent headwinds, the service sector remains well in expansion territory, and there are reasons for optimism. Though still historically elevated, the backlog of orders index and supplier deliveries index remain subdued from previous record highs set earlier in the pandemic. Meanwhile, recent movement in the inventories and inventory sentiment indexes suggest businesses are starting to finally re-stock their shelves, as both have broken into expansion territory. In other news this morning, initial unemployment claims declined 18,000 last week to 215,000. Continuing claims increased 2,000 to 1.476 million. In other employment news from yesterday, the ADP employment report showed 475,000 private-sector jobs gained in February (+984,000 including revisions to prior months). After plugging this into our model, we expect Friday's employment report to show a nonfarm payroll gain of 415,000. Finally, data out Monday showed that car and light truck sales fell 6.4% in February to a 14.1 million annual rate. Sales are down 11.7% from a year ago. Expect sales to generally rise from this level in the year ahead as supply-chain issues ease.