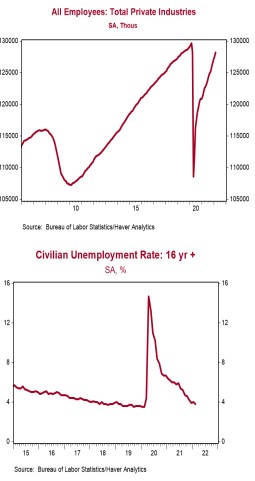

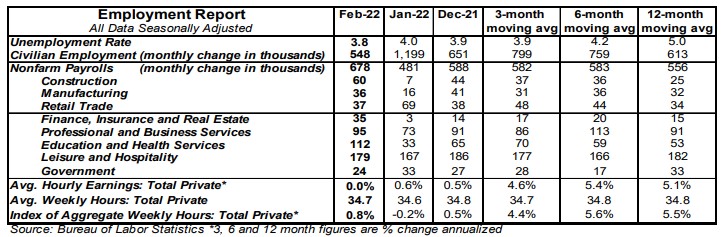

- Nonfarm payrolls increased 678,000 in February, well above the consensus expected 423,000. Payroll gains for December and January were revised by a total of 92,000, bringing the net gain, including revisions, to 770,000.

- Private sector payrolls rose 654,000 in February. The largest increases in February were for leisure & hospitality (+179,000), professional & business services (+95,000, including temps), health care & social assistance (+94,000), and construction (+60,000). Manufacturing rose 36,000 while government increased 24,000.

- The unemployment rate fell to 3.8% in February from 4.0% in January.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – were unchanged in February but up 5.1% versus a year ago. Aggregate hours rose 0.8% in February and are up 5.5%

from a year ago.

Implications:

The job market improved rapidly in February, almost completely top to bottom. Nonfarm payrolls rose 678,000 for the month while payrolls were revised up 92,000 for December and January. Meanwhile, civilian employment, an alternative measure of jobs that includes small-business start-ups, increased 548,000, confirming the strength. As a result of the increase in employment, the unemployment rate dropped to 3.8%, a new low for the economic recovery. Meanwhile, the labor force grew 304,000 in February and the labor force participation rate (the share of workers who are either working or looking for work) rose to 62.3%. That’s still below the 63.4% pre-COVID, but it’s the highest so far in the recovery. Some may quibble with the strength of the report because average hourly earnings were unchanged in February. However, that could be due to more lower-wage workers getting jobs, which is not a bad sign. Hourly wages are up 5.1% from a year ago, lagging inflation, and we expect that to be a persistent problem. Perhaps the best news in today’s report was a 0.8% increase in the total number of hours worked in the private sector in February. Hours are up 5.5% in the past year and are now only 0.2% off the pre-COVID peak. Digging into the guts of the report reveals more good news. The median duration of unemployment fell to 9.6 weeks versus 17.9 weeks a year ago. Meanwhile, the share of unemployed who decided to quit their prior job hit 15.1%, tying the highest level in the past twenty years. The Great Resignation is real. Putting all the data together, we think the improvements in the labor market will let the Federal Reserve focus in on fighting inflation, a fight they are starting woefully late. Look for a series of rate hikes starting later this month, with quantitative tightening starting by mid-year and ramping up more aggressively than during the prior cycle of rate hikes prior to COVID. The job market is still not perfect. Payrolls are still 2.1 million short of where they were before COVID. But we expect to close that gap later this year and then some, considering the loose stance of monetary policy.