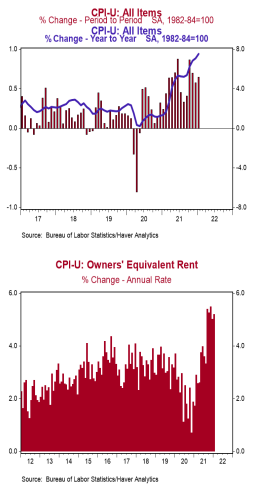

- The Consumer Price Index (CPI) increased 0.6% in January, well above the consensus expected +0.4%. The CPI is up 7.5% from a year ago.

- Food and energy prices both increased 0.9% in January. The “core” CPI, which excludes food and energy, rose 0.6% in January, more than the consensus expected 0.5%. Core prices are up 6.0% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.1% in January but are down 1.7% in the past year. Real average weekly earnings are down 3.1% in the past year.

Implications:

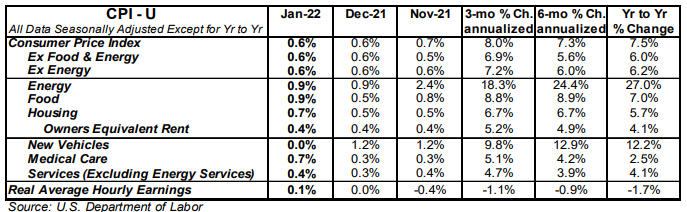

This is what we get when the Federal Reserve jacks up the M2 money supply by about 40% in two years and ignores Milton Friedman. Consumer prices rose 0.6% in January, pushing the 12-month increase to 7.5%, the largest in 40 years. Prices have shown no sign of slowing down too, up at an even faster 8.0% annualized pace in the last 3 months, and marked the fifth month in a row where it has beaten the consensus expected forecast. Inflation was broad-based in January, with shelter, electricity, and food leading the way. Housing rents (rents for both actual tenants and the rental value of owner-occupied homes) accelerated in January, rising 0.5% for the month, and accounting for nearly a quarter of the overall increase. Rents are important to watch now that a national eviction moratorium has ended and home prices are up a blistering 29% since COVID started. For some perspective, housing rents are up only 5.3% in that same timeframe. Rents make up more than 30% of the overall CPI, so we expect it to be a key driver for inflation in 2022 and the years to come. Meanwhile, energy prices rose 0.9% in January, driven by a 4.2% increase for electricity, which more than offset price declines for gasoline and natural gas (-0.8% and -0.5%, respectively). Food prices also increased 0.9%, on the backs of higher costs for nearly every major grocery store food group. Stripping out the volatile food and energy components, “core” prices rose 0.6% for the month and are up 6.0% in the past year, which is also another multi-decade high. It’s important to recognize the inflation experienced today is not merely a rebound from the steep price declines in 2020 when COVID first hit the US; consumer prices are up at a 4.5% annual rate since February 2020 and core prices are up 3.7%, both well above the Fed’s long-term inflation target of 2.0%. This inflation has never been transitory, and it appears the Fed has finally reached the same conclusion, as it’s signaled a readiness for multiple rate hikes in 2022. The bad news is the Fed is very late to the party. As the massive 40% increase in the money supply continues to gain traction, inflation will be a key indicator to watch in 2022. In other news this morning, initial unemployment claims fell 16,000 to 223,000 last week, and continuing claims were unchanged at 1.621 million. These figures signal continued job growth in February.