View from the Observation Deck

1. On 2/4/22, the S&P 500 Index closed the trading session at 4,500.53, which was 6.17% below its all-time closing high of 4,796.56 on 1/3/22, according to Bloomberg.

2. For the market to trend higher, we believe that corporate earnings will need to grow, and perhaps the best catalyst for growing earnings is to increase revenues.

3. From 1926-2021 (96 years), the S&P 500 Index posted an average annual total return of 10.46%, according to Morningstar/Ibbotson & Associates.

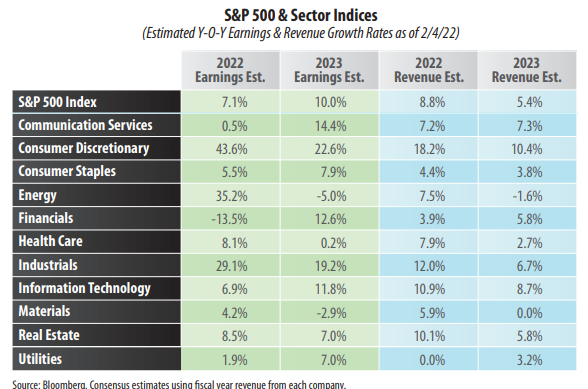

4. As indicated in the table, Bloomberg's 2022 and 2023 consensus year-over-year (y-o-y) earnings growth rate estimates for the index were 7.1% and 10.0%, respectively, as of 2/4/22.

5. Three of the 11 major sectors that comprise the index reflect a positive double-digit y-o-y earnings growth rate estimate for 2022, compared to five in 2023.

6. As indicated in the table, the only sector sporting a negative earnings growth rate projection for 2022 is financials. A couple of things to watch moving forward are inflation and the Treasury yield curve. High inflation can negatively impact banks, in particular, because it erodes the present value of current loans to be

paid off in the future, according to Investor’s Business Daily. The yield curve has been flattening of late and could flatten further, which could put additional pressure on bank profit margins. Keep in mind that analysts adjust these estimates throughout the year, so the narrative could shift.

7. Bloomberg's 2022 and 2023 consensus y-o-y revenue growth rate estimates for the S&P 500 Index were 8.8% and 5.4%, respectively, as of 2/4/22.

8. Eight of the 11 major sectors reflect y-o-y revenue growth rate estimates of 5.0% or more for 2022, compared to six for 2023. For comparative purposes, from 2011-2020, the 10-year average was 3.6%, according to S&P.

9. The following is a breakdown of the quarterly earnings growth rate estimates for the S&P 500 Index from Q4'21 through Q1'23 as of 2/4/22 (not in table): 28.7% (Q4'21); 5.6% (Q1'22); 4.2% (Q2'22); 8.4% (Q3'22); 7.8% (Q4’22); and 11.9% (Q1'23), according to Bloomberg.