View from the Observation Deck

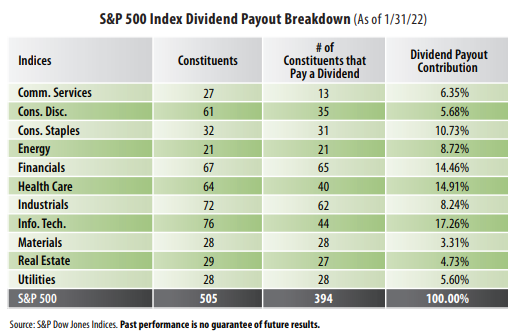

1. As of 1/31/22, 394 of the constituents in the S&P 500 Index distributed a cash dividend to shareholders. There are currently 505 stocks in the index.

2. For comparative purposes, since 1980, the highest number of dividend-paying stocks in the S&P 500 Index at year-end was 469 (1980), while the lowest number was 351 (2001 & 2002), according to S&P Dow Jones Indices.

3. As indicated in the chart, Information Technology, Health Care and Financials contributed the most to the S&P 500 Index's dividend payout at 17.26%, 14.91% and 14.46%, respectively, as of 1/31/22 (see table).

4. The S&P 500 Index sector weightings are as follows (1/31/22): 28.7% (Information Technology); 13.1% (Health Care); 12.0% (Consumer Discretionary); 11.3% (Financials); 10.0% (Communication Services); 7.8% (Industrials); 6.1% (Consumer Staples); 3.4% (Energy); 2.7% (Real Estate); 2.5% (Utilities); and 2.5% (Materials), according to S&P Dow Jones Indices.

5. As of 2/2/22, data from Bloomberg indicates that the dividend payments from the constituents in the S&P 500 Index totaled $60.54 per share (record high) in 2021, up from $58.95 (previous record high) in 2020. The estimates for 2022 and 2023 were $66.91 and $69.94, respectively. The S&P 500 Index's dividend yield was 1.32% as of 2/2/22.

6. A dividend payout ratio of 60% or less is typically a good sign that a dividend distribution is sustainable, according to The Motley Fool. A dividend payout ratio reflects the amount of money paid out as a dividend relative to a dollar's worth of earnings. In Q4'21, the payout ratio on the S&P 500 Index was 38.61%.

This chart is for illustrative purposes only and not indicative of any actual investment. There can be no assurance that any of the projections cited will occur. The illustration excludes the effects of taxes and brokerage commissions and other expenses incurred when investing. Investors cannot invest directly in an index. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance, while the 11 major S&P 500 Sector Indices are capitalization-weighted and comprised of S&P 500 constituents representing a specific sector. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.