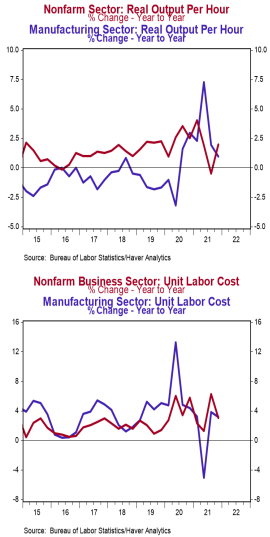

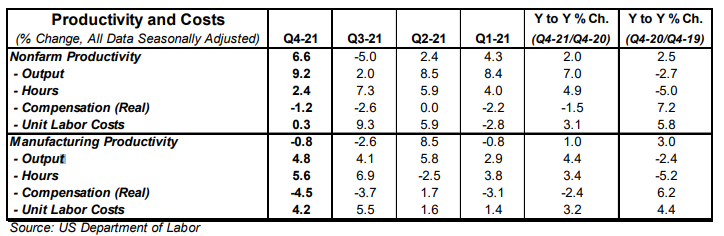

- Nonfarm productivity (output per hour) increased 6.6% at an annual rate in the fourth quarter, easily beating the consensus expected gain of 3.9%. Nonfarm productivity is up 2.0% versus last year.

- Real (inflation-adjusted) compensation per hour in the nonfarm sector declined at a 1.2% annual rate in Q4 and is down 1.5% versus a year ago. Unit labor costs rose at a 0.3% annual rate in Q4 and are up 3.1% versus a year ago.

- In the manufacturing sector, productivity declined at a 0.8% annual rate in Q4. Real compensation per hour fell at a 4.5% annual rate in the manufacturing sector, while unit labor costs rose at a 4.2% annual rate.

Implications:

Productivity grew at a robust pace in the fourth quarter, but in spite of increased hours and higher pay, rising inflation remains a key headwind for workers’ purchasing power. The 6.6% annualized increase in productivity in Q4 came as output and hours worked both rose, but output rose at a much faster pace, pushing output per hour higher. The 2.4% annualized increase in the hours worked index still leaves this measure 0.4% lower than it was in Q4 of 2019, the last quarter not affected by the COVID-19 pandemic. Output, however, with the 9.2% annualized increase in Q4, now stands 4.1% above the level in the fourth quarter of 2019. What this shows is that in spite of the pain of the COVID crisis, businesses made gains in enhancing efficiency. Although “real” (inflation-adjusted) compensation per hour fell at a 1.2% annualized rate in Q4, that doesn’t mean workers are being paid less. In fact, wages have been rising, they just haven’t been able to keep up with the outsized rise in inflation. This is likely to remain an ongoing issue in the coming quarters, as inflation remains elevated while the rehiring of lower-paid workers puts downward pressure on the average amount paid per hour. On the manufacturing front, productivity fell at a 0.8% annualized rate as hours rose quicker than output. We are now well into a recovery, but expect hours and output will continue to rise in the quarters ahead as the labor force continues to heal, supply-chain issues improve, and we work to get back to the level of output the U.S. would have seen had COVID never happened. In other news today, initial unemployment claims declined 23,000 last week to 238,000. Continuing claims fell 44,000 to 1.628 million. In other employment news yesterday, the ADP employment report showed 301,000 private-sector jobs lost in January. After plugging this into our model, we expect Friday’s employment report to show a modest nonfarm payroll gain of 45,000.