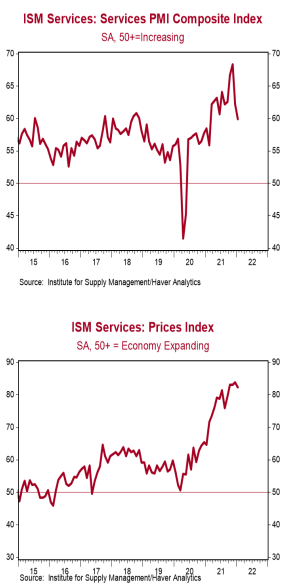

- The ISM Non-Manufacturing index declined to 59.9 in January, beating the consensus expected 59.5. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity moved mostly lower in January, but all stand above 50, signaling growth. The business activity index fell to 59.9 from 68.3, while the new orders index ticked down to 61.7 from 62.1. The supplier deliveries index rose to 65.7 from 63.9, while the employment index dropped to 52.3 from 54.7.

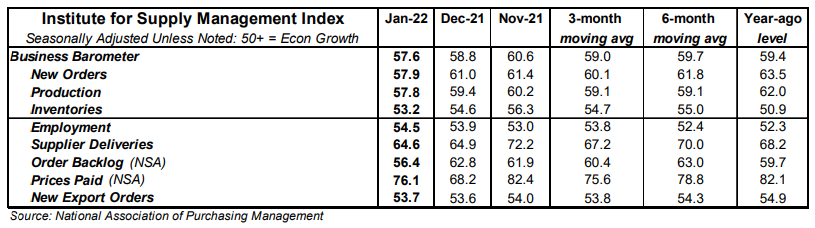

- The prices paid index fell to 82.3 in January from 83.9 in December.

Implications: The service sector continued to expand rapidly in January, but at a slightly slower pace, as rising COVID infections from the Omicron wave put a damper on activity. Gains remained broad-based, with fifteen of eighteen industries reporting growth. However, most major components moved lower, with both the new orders and business activity indices continuing to trend lower from their record-setting pace in November. Survey comments have been dominated by supply-chain-related woes since the beginning of the pandemic, and this month the recent wave of COVID infections from the Omicron variant exacerbated these issues. Notably, one respondent estimated between 20 and 25 percent of its workforce was out daily due to infection. The pace of hiring also slowed in January, with the employment index falling slightly from 54.7 to 52.3. Despite the short-term impacts of Omicron, we expect hiring in the service sector to be a tailwind for activity in the months ahead and help alleviate some of the supply-chain pressures that have been ingrained since the beginning of the pandemic. On that note, today’s report showed several reasons for optimism. Though historically elevated, the backlog of orders index fell for the third consecutive month to 57.4. Meanwhile, recent movement in the inventories and inventory sentiment indexes suggests businesses may start to finally re-stock their shelves, as both sit very close to expansion territory. Only time will tell if these improvements continue into 2022. Finally, the highest reading of any index in January continued to come from the prices index, which fell to a still elevated 82.3 from 83.9 in December. Unlike the manufacturing sector, price growth pressures have shown little sign of easing. Keep in mind that pre-pandemic, services made up roughly 69% of consumption spending. That number fell to 64% during the depths of the pandemic as people stopped going to concerts, movies, restaurants, etc. However, there are likely to be inflationary pressures and supply chain snags as spending continues to shift back to the pre-pandemic status quo. Our view continues to be that inflation remains a major problem but won't be quite as rapid in 2022 as it was last year.