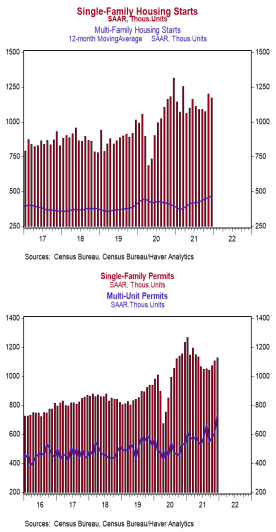

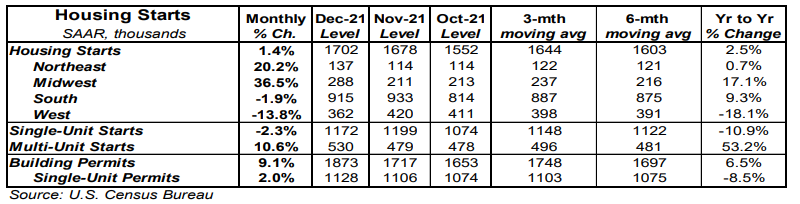

- Housing starts increased 1.4% in December to a 1.702 million annual rate, beating the consensus expected 1.650 million. Starts are up 2.5% versus a year ago.

- The gain in December was entirely due to multi-family starts. Single-family starts fell in December. In the past year, single-family starts are down 10.9% while multiunit starts are up 53.2%.

- Starts in December rose in the Midwest and Northeast but fell in the West and the South.

- New building permits increased 9.1% in December to a 1.873 million annual rate, easily beating the consensus expected 1.703 million. Compared to a year ago, permits for single-family units are down 8.5% while permits for multi-family homes are up 41.9%.

Implications:

Home building finished 2021 on a strong note, rising for a third consecutive month to end the year very close to the pandemic-era high-water mark. Looking at 2021 as a whole, 1.598 million homes were started, the fastest since 2006 and the 12th straight annual gain. This represents a significant achievement because the US needs roughly 1.5 million housing starts per year based on population growth and scrappage (voluntary knockdowns, natural disasters, etc.), and 2021 was the first year in the aftermath of the 2008/9 recession that has crossed that threshold. For 2021 as a whole, single-family starts were up 12.3% while multi-family starts rose 20.0%. But for December alone, multi-family was the only source of strength, rising 10.6% while single-family slipped 2.3%. It looks like developers finished the year by shifting some resources away from single-family homes and toward larger apartment buildings in response to rapidly rising rents as some people move back into big cities and the eviction moratorium ends. Zillow estimates that rental costs for new tenants are up 13.9% in the year ending in December and Apartmentlist.com estimates they have risen an even faster 17.8%, easily exceeding typical gains in the 3.0 – 4.0% range. Recent distributional effects aside, housing construction remains healthy. While the monthly pace of activity will ebb and flow as the recovery continues, we expect housing starts to trend upward in the next couple of years. Builders still have a huge number of permitted projects sitting in the pipeline waiting to be started. In fact, the backlog of projects that have been authorized but not yet started is currently the highest since the series began back in 1999. Meanwhile, permits for new building projects rose 9.1% in December, the largest monthly gain in seventeen months, demonstrating that builders see even more demand on the horizon. With plenty of future building activity in the pipeline, builders looking to boost the inventory of homes and meet consumer demand, and as more Millennials finally enter the housing market, it looks very likely construction will move higher in 2022. In other recent housing news, the NAHB Housing Index, which measures homebuilder sentiment, declined slightly to 83 in January from 84 in December. However, these readings remain near historical highs, signaling robust optimism from developers. In recent news on the manufacturing front, the Empire State Index, a measure of New York factory sentiment, declined unexpectedly to -0.7 in January from +31.9 in December. Most of this is due to short-term factors surrounding the outbreak of Omicron cases in the region. Look for a rebound in the months ahead.