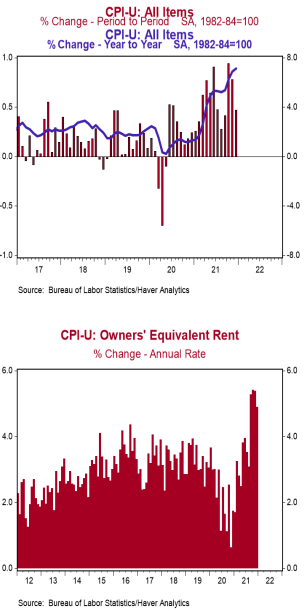

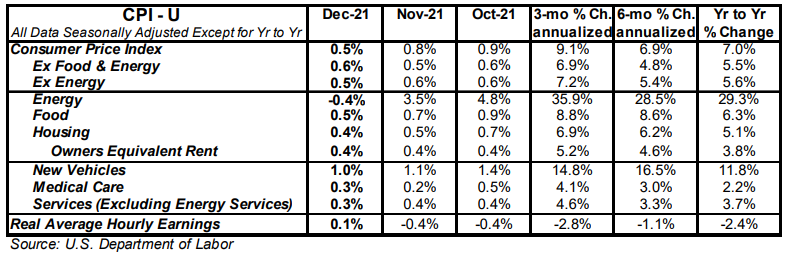

- The Consumer Price Index (CPI) increased 0.5% in December, more than the consensus expected +0.4%. The CPI is up 7.0% from a year ago.

- Food prices increased 0.5% in December, while energy prices decreased 0.4%. The “core” CPI, which excludes food and energy, rose 0.6% in December, more than the consensus expected 0.5%. Core prices are up 5.5% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.1% in December but are down 2.4% in the past year.

Real average weekly earnings are down 2.3% in the past year.

Implications:

Consumer prices continued their rapid ascent in December, rising 0.5% for the month, and pushing the 12-month increase for the year of 2021 to 7.0%, the largest in nearly 40 years. Inflation in December was broad-based, with shelter, food, and new and used vehicles all making significant contributions. Housing rents (rents for both actual tenants and the rental value of owner-occupied homes) showed no signs of slowing down, rising 0.4% for the fourth consecutive month. Rents are important to watch now that a national eviction moratorium has ended and home prices are up a blistering 28% since before COVID. Rents make up more than 30% of the overall CPI, so we expect it to be a key driver for inflation in 2022 and the years to come. Meanwhile, food prices increased 0.5% on the backs of higher costs for dairy as well as fruits and vegetables. Energy prices declined 0.4% in December, as prices for gasoline and natural gas both decreased (-0.5% and -1.2%, respectively). Stripping out the volatile food and energy components, “core” prices rose 0.6% for the month and are up 5.5% in the past year, which is also another multi-decade high. Prices for new and used vehicles continue to be a driver for core inflation, rising 1.0% and 3.5% , respectively, for the month. It’s important to recognize the inflation experienced today is not merely a rebound from the steep price declines in 2020 when COVID first hit the US; consumer prices are up at a 4.4% annual rate since February 2020 and core prices are up 3.6%, both well above the Fed’s long-term inflation target of 2.0%. The December 2020 forecast from the Fed for inflation in 2021 to come in at 1.8% shows its models fundamentally misunderstand the driver of sustained inflation. This inflation has never been transitory, and it appears the Fed has finally arrived at the same conclusion by announcing a pickup in the pace of tapering asset purchases and signaling a readiness for multiple rate hikes in 2022. The bad news is the Fed is very late to the party. As the massive 39% increase in the money supply continues to gain traction, inflation will be a key indicator to watch in 2022.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.