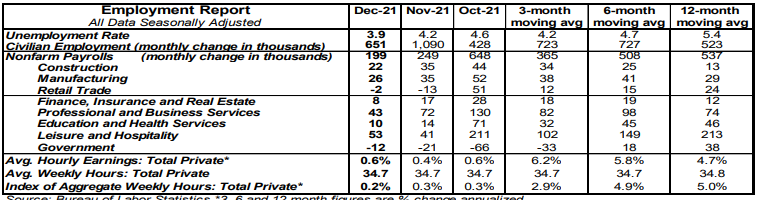

• Nonfarm payrolls increased 199,000 in December, well below the consensus expected 450,000. Payroll gains for October and November were revised up by a total of 141,000, bringing the net gain, including revisions, to 340,000.

• Private sector payrolls rose 211,000 in December, while revisions to prior months added 121,000. The largest increases in December were for restaurants & bars (+43,000), professional & business services (+43,000, including temps), and manufacturing (+26,000). Government declined 12,000.

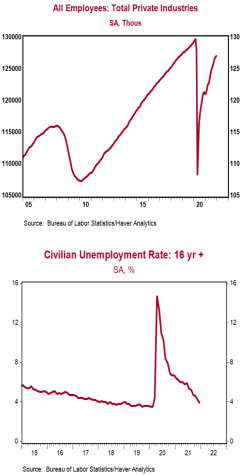

• The unemployment rate dropped to 3.9% in December from 4.2% in November.

• Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.6% in December and are up 4.7% versus a year ago. Aggregate hours worked rose 0.2% in December and are up 5.0% from a year ago.

Implications:

Nonfarm payrolls grew 199,000 in December, falling well short of consensus expectations for the fourth time in the last five months. However, the details of the report were better than the headline growth in payrolls. In what has also become a monthly ritual – not every month, but almost every month – there were upward revisions to prior reports, this time by a combined 141,000 for October and November. Adding those in, today’s report shows a total increase in payrolls of 340,000. Meanwhile, civilian employment, an alternative measure of jobs that includes small-business startups increased 651,000 in December, helping push down the unemployment rate to 3.9%. That figure is significant because the Federal Reserve’s best guess about the long-term average unemployment rate is 4.0% and it has strongly hinted that going below 4.0% is a key trigger for starting to raise short-term interest rates. In other words, if the Fed really is determined to raise rates three times in 2022, and perhaps start reducing its balance sheet soon thereafter, today’s report should help justify those positions, even though the gain in payrolls in December itself lagged consensus expectations. Other positive news today included a 0.6% increase in average hourly earnings, which are now up 4.7% from a year ago. Total hours worked rose 0.2% in December and are up 5.0% from a year ago. Combining hourly pay and the number of hours worked, total worker pay (excluding irregular bonuses) has increased 9.9% in the past year and is up 8.5% since February 2020 (pre-COVID). This is important for two reasons: first, it means the growth in total worker pay has roughly kept pace with inflation; second, it means total worker pay is now roughly back to the pre-COVID trend (where it’d be if COVID had never happened). The difference compared to the pre-COVID trend is that fewer people are working, but with much higher pay per worker. The labor force participation rate (the share of adults who are either working or looking for work), is still down substantially versus pre-COVID, but, at 61.9% the past two months, is the highest so far in the recovery. Once again, don’t be surprised if this payroll report is revised upward in the next two months while the pace of job growth picks up in future months, as well. Still, the labor market is far from fully healed. Payrolls remain 3.6 million below where there were in February 2020 while civilian employment is 2.9 million below. Assuming the Biden Administration’s OSHA rules are not resurrected and other new burdensome rules and restrictions aren’t imposed, the labor market should continue to heal.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.