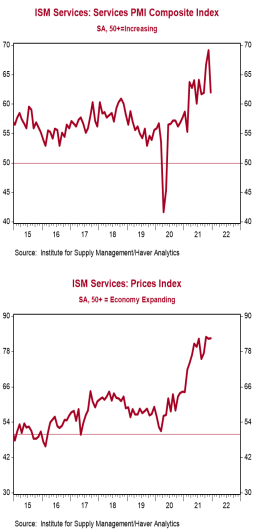

• The ISM Non-Manufacturing index declined to 62.0 in December, well below the consensus expected 66.9. (Levels above 50 signal expansion; levels below signal contraction.)

• The major measures of activity moved mostly lower in December, but all stand comfortably above 50, signaling growth. The business activity index fell to 67.6 from 74.6, while the employment index fell to 54.9 from 56.5. The new orders index fell to 61.5, while the supplier deliveries index dropped to 63.9.

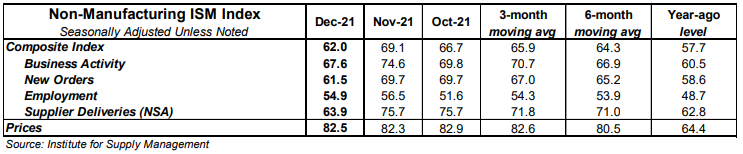

• The prices paid index ticked up to 82.5 from 82.3 in November.

Implications:

The service sector continued to expand rapidly in December, though not as fast as the record-setting pace in November, as news about the Omicron variant hit more pandemic-sensitive industries. Gains remained broadbased, with sixteen of eighteen industries reporting growth. However, most major components moved lower, with both the new orders and business activity indices falling from record highs. Survey comments continue to be dominated by discussions related to supply-chain shortages, signaling the possibility of even faster growth in the service sector if these problems can be fixed. On that note, today’s report showed recent progress for supply-chains on several fronts. Though still historically elevated, the backlog of orders index fell for the second consecutive month. Meanwhile, the supplier deliveries index posted its largest monthly decline since 1997, signaling shorter wait times for inputs. Only time will tell if these improvements continue into the start of 2022, but recent similar movements from the ISM Manufacturing report out earlier this week also signal that the tide may be shifting. The pace of hiring also slowed in December, with the employment index falling slightly from 56.5 to 54.9. Despite the short-term impacts of Omicron, we expect hiring in the service sector to be a tailwind for activity in the months ahead and help alleviate some of the supply-chain pressures that have been ingrained since the beginning of the pandemic. The one major component of today’s report that moved higher was the index of price growth, which rose to 82.5 from 82.3 in November. While the rate of price growth in the manufacturing sector has been slowing recently, we are seeing the opposite in services. This is likely the result of Americans beginning to shift their consumption preferences back to services from goods. Keep in mind that pre-pandemic, services made up roughly 69% of consumption spending. That number fell to 64% during the depths of the pandemic as people stopped going to concerts, movies, restaurants, etc. However, there are likely to be inflationary pressures and supply chain snags as spending continues to shift back to the prepandemic status quo.

Some of those sectors include:

- Accommodation and Food Services

- Agriculture, Forestry, Fishing, and Hunting

- Arts, Entertainment, and Recreation

- Educational Services

- Finance and Insurance

- Health Care and Social Assistance

- Management of Companies and Support Services

- Professional, Scientific, and Technical Services

- Public Administration

- Real Estate, Rental, and Leasing

- Retail Trade

- Transportation and Warehousing

- Wholesale Trade

- Utilities