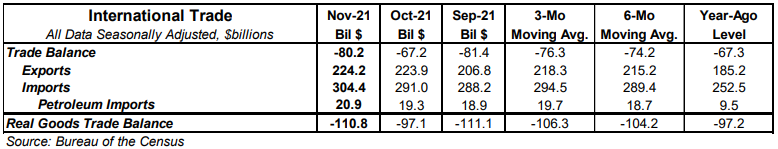

• The trade deficit in goods and services grew to $80.2 billion in November, coming in slightly smaller than the consensus expected $81.0.

• Exports rose by $0.4 billion, led by international travel and transport. Imports rose $13.4 billion, led by finished metal shapes, crude oil, and autos.

• In the last year, exports are up 21.1% while imports are up 20.6%.

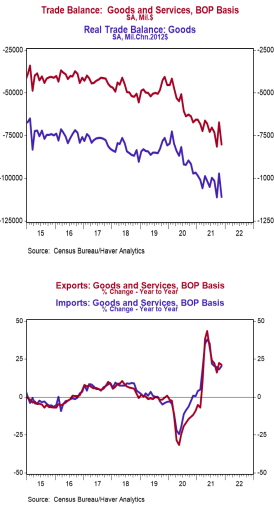

• Compared to a year ago, the monthly trade deficit is $12.9 billion larger; after adjusting for inflation, the “real” trade deficit in goods is $13.6 billion larger than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications:

The trade deficit grew to $80.2 billion in November, as imports grew much faster than exports. We like to follow the total volume of trade (imports plus exports), which signals how much businesses and consumers interact across the US border. That measure rose 2.7% in November, is up 20.8% versus a year ago, and sits at record highs. In general, the increase in the total volume of trade signals a recovery from COVID-19. Expect the trade deficit to remain volatile from month to month but remain large in the months ahead as the US is recovering from the coronavirus faster than most other countries. This means the demand for imports should continue to outstrip the demand for exports to the rest of the world. Also, the US is still running low on inventories for many goods due to the surge in consumer spending, which has been artificially boosted by large government checks to consumers. That means the appetite for imports will remain much stronger than normal as companies try to restock their shelves and warehouses. Supplychain issues haven’t improved as ports remain overwhelmed in the US. For example, the port of Los Angeles currently has 53 container vessels waiting to be unloaded with the average anchorage time right now at 23.4 days. Omicron cases in the United States continue to rage on, but we still do not expect states to re-institute the large scale restrictions that hampered activity in 2020, so look for overall trade to keep expanding in the coming months as businesses across the US get back on their feet. In other news today, initial unemployment claims rose 7,000 last week to 207,000. Continuing claims increased 36,000 to 1.754 million. In other employment news yesterday, the ADP employment report showed 807,000 private-sector jobs gained in December. After plugging this into our model, we expect Friday’s employment report to show a nonfarm payroll gain of 465,000. Finally, cars and light trucks were sold at a 12.72 million annual rate in December. For the year as a whole, 2021 auto sales rose 3.5% from 2020 (from 14.58 million to a 15.1 million pace) but remain well below 2019 levels where they sold at a 17.06 million pace. The key impediment to auto sales remains supply constraints, largely related to a lack of computer chips. Look for that problem to ease over 2022, resulting in a faster pace of sales.