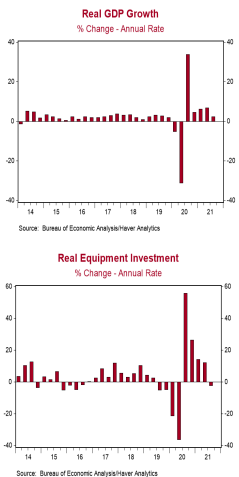

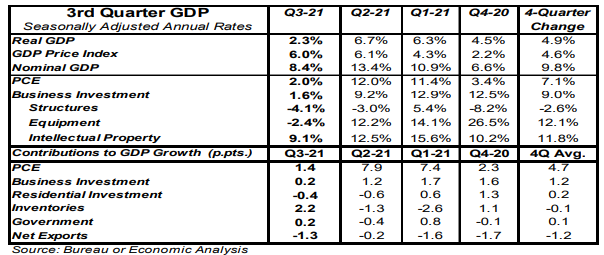

- Real GDP growth in Q3 was revised up to a 2.3% annual rate from a prior estimate of 2.1%, beating the consensus expected 2.1%.

- Upward revisions to consumer spending and inventories more than offset a \downward revision to net exports.

- The largest positive contributions to the real GDP growth rate in Q3 were inventories and consumer spending. The weakest component was net exports.

- The GDP price index was revised up to a 6.0% annual growth rate from a prior estimate of 5.9%. Nominal GDP growth – real GDP plus inflation – was revised up to an 8.4% annual rate from a prior estimate of 8.1%.

Implications:

Real GDP growth in the third quarter was revised slightly higher, growing at a 2.3% annual rate, although still showing a substantial slowdown from the 6.5% in the first half of the year when the federal government was

passing out checks like they were going out of style. The slight upward revision to the overall number in Q3 was mainly due to an upward revision in consumer spending, specifically in services. Inventories were also revised slightly higher while net exports slightly lower, essentially offsetting each other. Inventories were the main driver of growth in Q3, contributing 2.2 percentage points, but not because they increased. Inventories fell in Q3, but they did so much more slowly than they did in Q2, resulting in being additive to real GDP. (Yes, we know that sounds weird, but that’s how the GDP accounting works.) Consumer spending also rose in Q3, due to non-durables and services, even though spending on autos fell at a 50.3% annual rate. Today we also got our second look at economy-wide Q3 corporate profits, which were revised lower, but still sit at record highs. Profits rose 3.4% from the second quarter and were up 19.7% from a year ago. Profits rose at both domestic non-financial corporations and domestic financial corporations, and also from operations abroad. Our capitalized profits model suggests US equities remain cheap, not only at today’s interest rates but even using a 10-year Treasury yield of 2.00%+. Notably, corporate profits have already made a V-shaped recovery from the plunge last year as the pandemic was first erupting in the US.