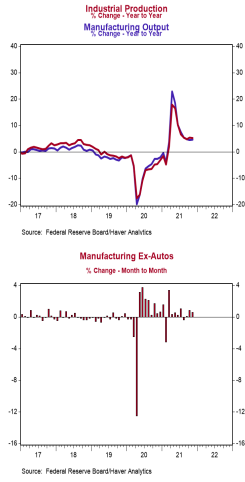

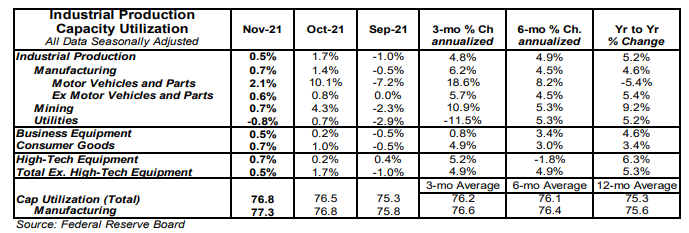

- Industrial production increased 0.5% in November, slightly below the consensus expected gain of 0.6%. Utilities output fell 0.8% in November, while mining increased 0.7%.

- Manufacturing, which excludes mining/utilities, rose 0.7% in November. Auto production increased 2.1%, while non-auto manufacturing rose 0.6%. Auto production is down 5.4% versus a year ago, while non-auto manufacturing is up 5.4%.

- The production of high-tech equipment rose 0.7% in November and is up 6.3% versus a year ago.

- Overall capacity utilization increased to 76.8% in November from 76.5% in October. Manufacturing capacity utilization rose to 77.3% in November from 76.8%.

Implications:

US industrial activity continued to improve in November, following large gains in October as factories came back online after temporary disruptions from Hurricane Ida. Gains were broad-based in November as well, with nearly every major category posting an increase. Looking at the details, the manufacturing sector led the headline index higher, rising 0.7%, with both auto and non-auto manufacturing contributing. Notably, the auto sector posted its first back-to-back gain of 2021, and while it’s too early to tell for sure, this may be an early signal that some supply-chain issues like the lack of semiconductors may be beginning to ease. Meanwhile, activity in the mining sector (think oil rigs in the gulf) rose 0.7% in November as well. We expect this sector to be a tailwind for overall industrial production in the months ahead as activity still remains 8.2% below pre-pandemic levels and has lagged the recovery elsewhere. The announcement of the COVID-19 Omicron variant recently sent energy prices tumbling, but we think prices will recover and continue to incentivize oil and gas extraction as the worst initial fears dissipate. Looking at things more broadly, today’s gains put industrial production 1.0% above pre-pandemic levels. This means production still has a long way to go to meet current demand. For context, yesterday’s report on retail sales showed that even after adjusting for inflation, “real” retail sales are up 12.9% over that same time period. Ongoing issues with supply chains and labor shortages are hampering a more robust rise in activity, with job openings in the manufacturing sector currently at a record high and 150% above prepandemic levels. This mismatch between supply and demand, is why inflation has accelerated so sharply. Normally easy money takes 18-24 months to show up as inflation. As supply chains heal inflation will moderate, but while supply chain issues are transitory, excess M2 growth is not. Look for industrial production to continue bouncing back in the months ahead. In other recent manufacturing news, the Philadelphia Fed Index, a measure of factory sentiment in that region, fell to +15.4 in December from +39.0 in November.