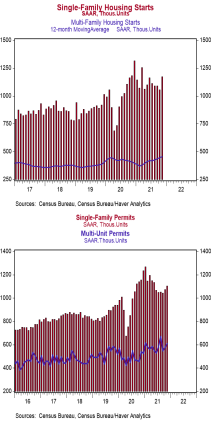

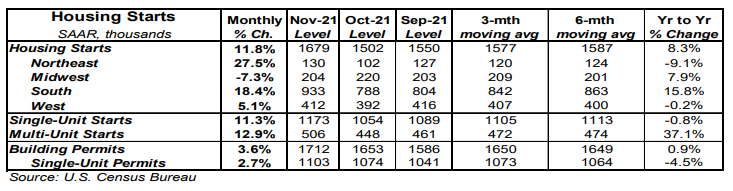

- Housing starts increased 11.8% in November to a 1.679 million annual rate, easily beating the consensus expected 1.567 million. Starts are up 8.3% versus a year ago.

- The gain in November was due to both single-family and multi-family starts. In the past year, single-family starts are down 0.8% while multi-unit starts are up 37.1%.

- Starts in November rose in the Northeast, South, and West, but fell in the Midwest.

- New building permits increased 3.6% in November to a 1.712 million annual rate, beating the consensus expected 1.661 million. Compared to a year ago, permits for single-family units are down 4.5% while permits for multi-family homes are up 12.6%.

Implications:

Housing construction surprised to the upside in November, posting the largest monthly gain in eight months to come in higher than even the most optimistic forecast by any economics group. The details of today’s report were strong as well, with new construction of both single and multi-family homes posting double-digit percentage gains. Notably, in the past year multi-family starts are up 37.1% while single-family starts have fallen 0.8%. It looks like developers may be shifting some resources away from single-family home construction and toward larger apartment buildings in response to rapidly rising rents as some people move back into big cities and the eviction moratorium ends. Zillow estimates that rental costs for new tenants are up 12.6% in the year ending in

November and Apartmentlist.com estimates they have risen an even faster 17.7% over that period, easily exceeding typical gains in the 3.0 – 4.0% range. Recent distributional effects aside, housing construction remains healthy. Looking at the 12-month moving

average of overall housing starts to help sift through recent volatility shows residential construction now stands at the fastest pace since 2007. While the monthly pace of activity will ebb and flow as the recovery continues, we expect housing starts to trend upward in the next couple of years. Builders still have a huge number of permitted projects sitting in the pipeline waiting to be started. In fact, despite the large gain in new construction in November, the backlog of projects that have been authorized but not yet started is currently the highest since the series began back in 1999. Meanwhile, permits for new building projects rose 3.6% in November, demonstrating that builders see even more demand on the horizon. Keep in mind, the US needs roughly 1.5 million housing starts per year based on population growth and scrappage (voluntary knockdowns, natural disasters, etc.). However, we haven’t built that many new homes in any calendar year since 2006. With plenty of future building activity in the pipeline, builders looking to boost the inventory of homes and meet consumer demand, and as more Millennials finally enter the housing market, it looks very likely construction in 2021 will cross the 1.5 million unit benchmark this year and then move higher in 2022. In other recent housing news, the NAHB Housing Index, which measures homebuilder sentiment, increased to 84 in December from 83 in November. This is the fourth consecutive monthly gain, and the index remains near historical highs, signaling improving optimism from developers. In employment news this morning, initial unemployment claims rose 18,000 to 206,000 last week. Meanwhile, continuing claims fell 154,000 to 1.845 million, a new low for the pandemic recovery.