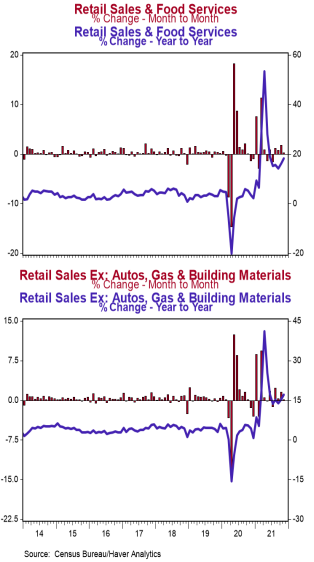

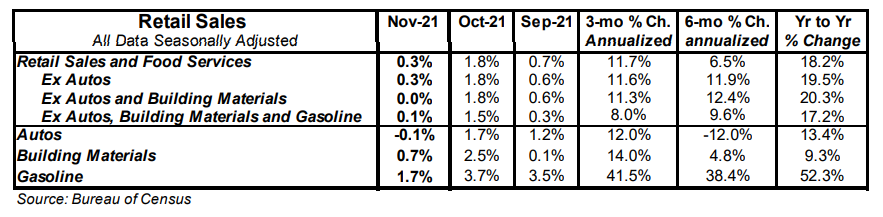

- Retail sales rose 0.3% in November, short of the consensus expected gain of 0.8%.

- Retail sales are up 18.2% versus a year ago.

Sales excluding autos increased 0.3% in November, below the consensus expected gain of 0.9%. These sales are up 19.5% in the past year. Excluding gas, sales rose 0.1% in November, and are up 15.8% from a year ago. - The gain in sales in November was led by food & beverage stores, gas stations, and restaurants & bars. The largest decline was at general merchandise stores.

- Sales excluding autos, building materials, and gas rose 0.1% in November. If unchanged in December these sales will be up at a 10.6% annual rate in Q4 versus the Q3 average.

Implications:

Retail sales continued to grow in November, but came in below consensus expectations, rising 0.3% for the month. It looks like consumers pulled forward some of their Christmas shopping into October (when sales rose a whopping 1.8% for the month) as fears of shortages were on everyone’s mind. This makes sense as only eight of the thirteen major categories were up in November, and the leaders – food & beverage stores, gas stations, and restaurants & bars – had little do with overall Christmas shopping. Still, overall sales are up a robust 18.2% from a year ago. Another way to look at it is that sales are up 21.7% versus February 2020, which was pre-COVID. “Core” sales, which exclude the most volatile categories of autos, building materials, and gas station sales, rose 0.1% in November, are up 17.2% from a year ago, and up 20.9% versus February 2020. In other words, due to the massive increase in government transfer payments in response to COVID which created artificial demand, retail sales are running much hotter than they would have had COVID never happened, even as the level of output (real GDP) is still running lower than it would have been in the absence of COVID. It has not been an even recovery for all major categories, though. For instance, non-store retailers (+40.5%), sporting goods stores (+39.8%), and gas stations (+31.8%) have grown significantly faster than overall retail sales since February 2020. The last category of sales to get above February 2020 levels was restaurants & bars, which finally moved into the green in April and are now up a solid 11.4% from 21 months ago. Looking ahead, given that overall retail sales are still far above the pre-COVID trend, we expect a modest trend decline in the year ahead. However, as long as policymakers don't panic again about COVID, we also expect an increase in sales of services not counted by the retail trade report, as America gets back toward normal. In the months ahead, the path of retail sales will be a battle between a number of opposing factors. Rising wages, jobs, and inflation will all be tailwinds for retail sales, while the waning of the temporary and artificial boost from “stimulus” checks along with the end to overly excessive

jobless benefits will be headwinds. In other news this morning, import prices rose 0.7% in November while export prices increased 1.0%. In the past year, import prices are up 11.7%, while export prices are up 18.2%. These figures add to the evidence that the Federal Reserve is too loose. Also, today on the manufacturing front, the Empire State Index, a measure of New York factory sentiment, rose to +31.9 in December from +30.9 in November.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.