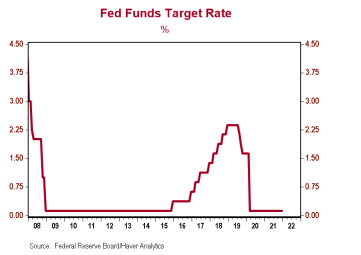

A renominated Powell is a different Powell. The Federal Reserve didn’t raise interest rates today, a policy move we think is overdue, but it made major changes that set the stage for multiple rate hikes in 2022 and beyond.

First, the Fed doubled the pace of tapering to a speed where it could completely end quantitative easing by March, rather than in June. That’s important because the Fed has said it wants to finish tapering before it considers raising rates. An earlier end to QE means a potential earlier start for rate hikes.

Second, the Fed’s “dot plots,” which show the pace of rate hikes expected by policymakers, now suggest three rate hikes in 2022 (assuming they’re 25 basis points each), another three hikes in 2023, and two more in 2024. That contrasts sharply with the dot plot from September, when policymakers were evenly split on whether there’d be any rate hikes at all in 2022 and suggested a total of four rate hikes in 2022 and 2023, combined.

Third, the Fed officially removed from its statement the reference to inflation being “transitory,” but maintained a reference to “supply and demand imbalances” as the key factor behind elevated inflation. Demand-driven inflation is exactly the kind of inflation for which policymakers think rate hikes are appropriate.

Fourth, the Fed statement added that “[W]ith inflation having exceeded 2 percent for some time, the Committee expects it will be appropriate to maintain [short-term rates near zero] until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment.” In turn, the Fed maintained its view that the long-run average unemployment rate is 4.0% while changing its economic forecast to show the job market hitting 4.0% in the Spring. It’s almost as if the Fed wants to limit its own discretion about raising rates. Putting this altogether, it sure looks like the Fed will be ready to start raising rates by June, if not earlier.

Fifth, the Fed went out of its way to make changes to the statement that “talked up” the economy, referring to solid job gains and a substantial decline in unemployment. At the press conference, Powell noted “high inflation,” “strong

growth,” and “rapid progress toward maximum employment.”

Before today, we had thought that Fed policymakers would chicken out of raising rates more than once next year. But, given the tenor of today’s Fed statement – including the use of the labor market as a guide for when they think rate hikes

could start, the sharp change in the dot plots, as well as Powell’s willingness to sound hawkish in the press conference – we think two or three rate hikes is a reasonable projection for 2022.

Yes, economic circumstances may change. The Fed anticipates 4.0% real GDP growth next year and we think the economy will probably come in slower. But the Fed also expects 2.6% PCE inflation next year and we think actual inflation will come in higher. Net-net, we think there’s ample room for rate hikes, although we still doubt the Fed would raise rates during a stock market correction. Ultimately, we view today as good news for the long-term health of the US economy. The Fed is behind the curve on fighting inflation, tapering should already be over, and rate

hikes should already have begun. Today’s changes and positioning by the Fed are long overdue, but a big step in the right direction.

The Fed needed to end its pandemic monetary response at some point and today’s news is welcome in that regard. However, we are puzzled slightly by the market response. Stocks rose sharply and bond yields barely budged. It’s

almost as if now that the Fed has stopped saying transitory, the market has decided that inflation really is transitory.

We aren’t so sanguine. Yes, we still think stocks will end 2022 higher (5,250 for the S&P 500), but inflation is not going to go away easily. And it is hard to imagine a world where bond yields stay significantly below inflation forever. So, we will take the near-term victory of a more sane Federal Reserve policy, but still question the ability of policymakers to bring the US economy in for a perfectly soft landing.

Brian S. Wesbury, Chief Economist

Robert Stein, Deputy Chief Economist

Text of the Federal Reserve's Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but continue to be affected by COVID-19. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in

inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation having exceeded 2 percent for some time, the Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment. In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities. Beginning in January, the Committee will increase its holdings of Treasury securities by at least $40 billion per month and of agency

mortgage‑backed securities by at least $20 billion per month. The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook. The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.