Stock Market

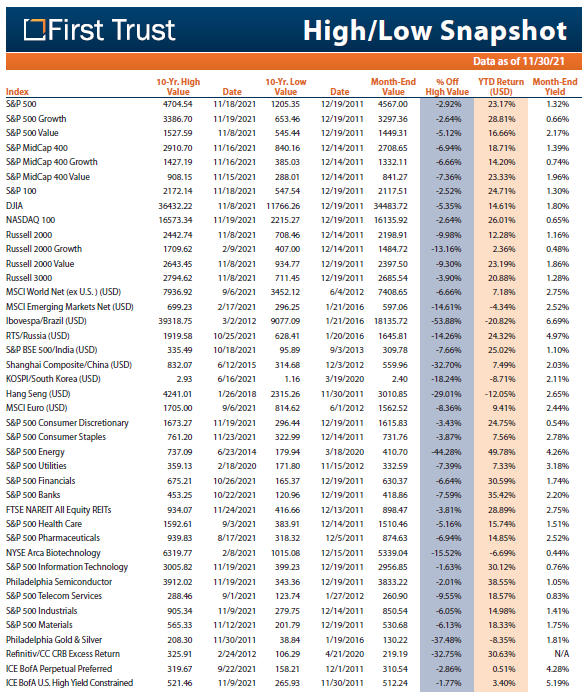

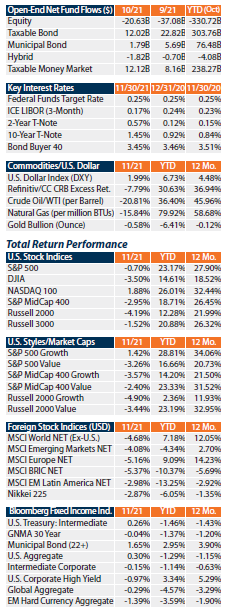

The S&P 500 Index closed November at 4,567.00, 2.92% below its all-time closing high of 4,704.54 on 11/18/21, according to Bloomberg. The S&P MidCap 400 and S&P SmallCap 600 Indices stood 6.94% and 8.38%, respectively, below their record closing highs as of monthend. The S&P 500 Index (“index”) posted a total return of -0.70% in November. Only two of the 11 major sectors that comprise the index were up on a total return basis. The topperformer was Information Technology, up 4.35%, while the worst showing came from Financials, down 5.68%. The S&P 500 Index posted a total return of 23.17% over the first 11 months of 2021. All 11 major sectors were up on a total return basis. The index’s top performer was Energy, up 49.78%, while the worst showing came from Utilities, up 7.33%. A Bloomberg survey of 12 equity strategists found that their average 2022 year-end price target for the S&P 500 Index was 4,843 as of 11/19/21, according to its own release. The

highest and lowest estimates were 5,300 and 4,400, respectively. Global dividends increased by 22.0% year-over-year to $403.5 billion in Q3'21, as measured by the Janus Henderson Global Dividend Index, according to its own release. That is an all-time high for a third quarter. The U.S. accounted for $130.7 billion of that total, also a record high for a third

quarter. Globally, 90% of companies either raised their dividend payout or maintained it.

Janus Henderson estimates that global dividend payments will total $1.46 trillion in 2021. It expects dividends to surpass the pre-pandemic peak by year-end. Investors should keep in mind that some pundits are forecasting the potential for a correction (price decline of 10.00% to 19.99% on an equity index from its most recent peak) in the coming months. The

S&P 500 Index has experienced a correction or bear market around every 1.87 years since 1950, according to Yardeni Research. The last correction, which actually ended up a bear market (20% or more price decline), occurred in February-March of 2020 during the onset of COVID-19. That was 20 months ago. The fact that the Fed is contemplating a faster than

expected tapering of its monthly bond buying program to help mitigate rising inflation by pushing bond yields higher will likely embolden the forecasters.